Australian shares endured their sharpest drop since the risk-off move in early August, with the ASX200 falling 1.88% to 7950. Declines were broad-based across sectors and stocks as global growth fears resurfaced. This followed weaker-than-expected US manufacturing data and sharply lower oil prices. Local miners and energy stocks came under pressure. Local GDP data confirmed that many Aussies are doing it tough, with a rare decline in household consumption.

The ASX200 will likely retest the big support level at 7600 in the weeks ahead, with growth scares and concerns around a global slowdown likely to be the catalyst.

GDP growth per capita went backwards for the 6th consecutive quarter, which has not happened since the early 1990s recession. The only factors preventing an outright recession are government spending, hiring and immigration. The private sector pretty much stopped hiring some time ago.

ABS data showed that Australia’s economy grew by just 0.2% in the June quarter and 1% over the past year, marking the slowest annual growth outside the pandemic period since 1991-92. This matched muted expectations.

Household spending, which makes up half of GDP, fell by 0.2%, diving after two quarters of growth. Many are having to tighten their belts and choose lower-cost alternatives, like eating more at home.

Carpe Diem!

Angus

Disclosure: Fat Prophets and its affiliates, officers, directors, and employees may hold an interest in the securities or other financial products relating to any company or issuer discussed in this report. Fat Prophet’s disclosure of interest related to Investment Recommendations can be provided upon request to members@fatprophets.com.au.

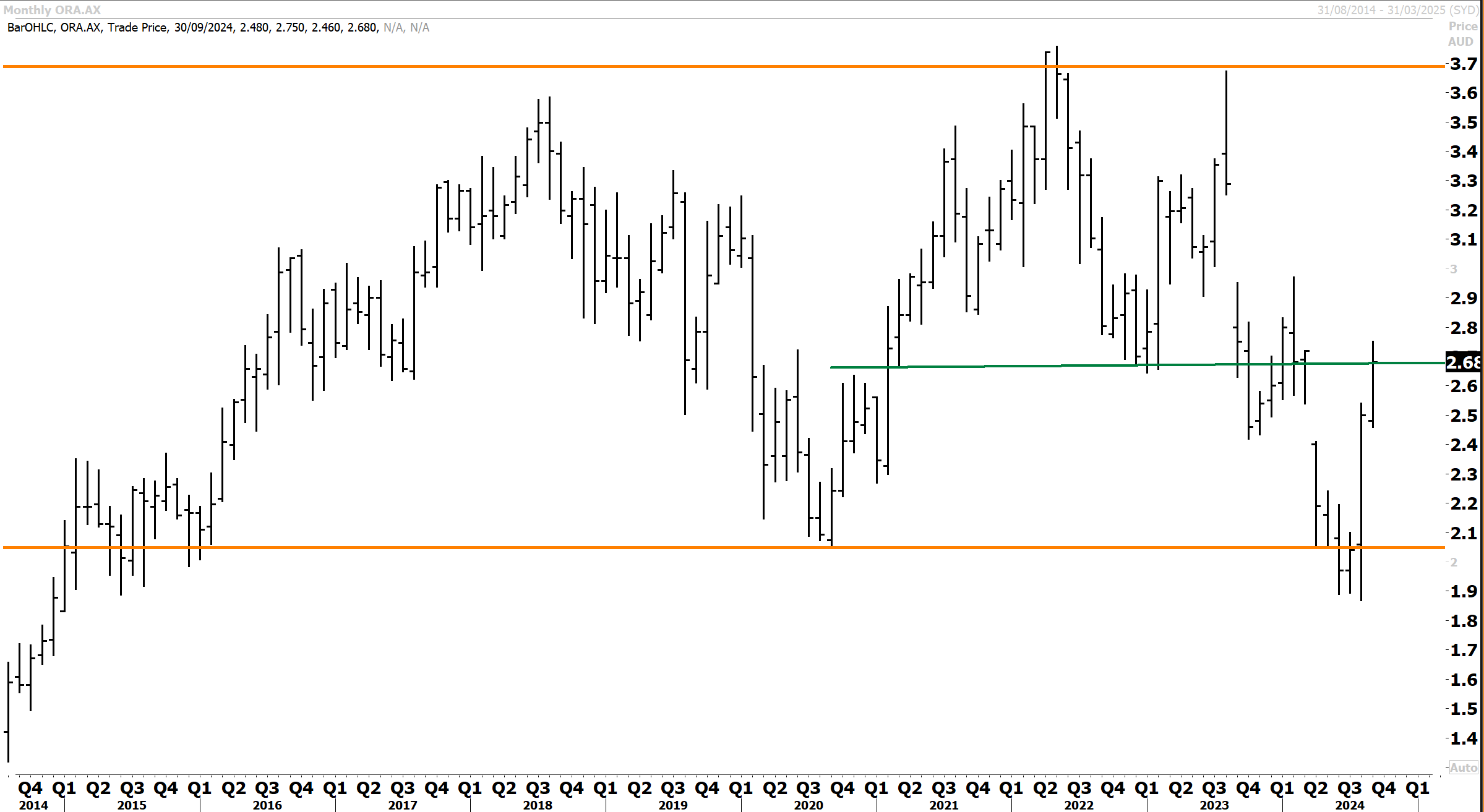

Stock Chart Source: Thomson Reuters