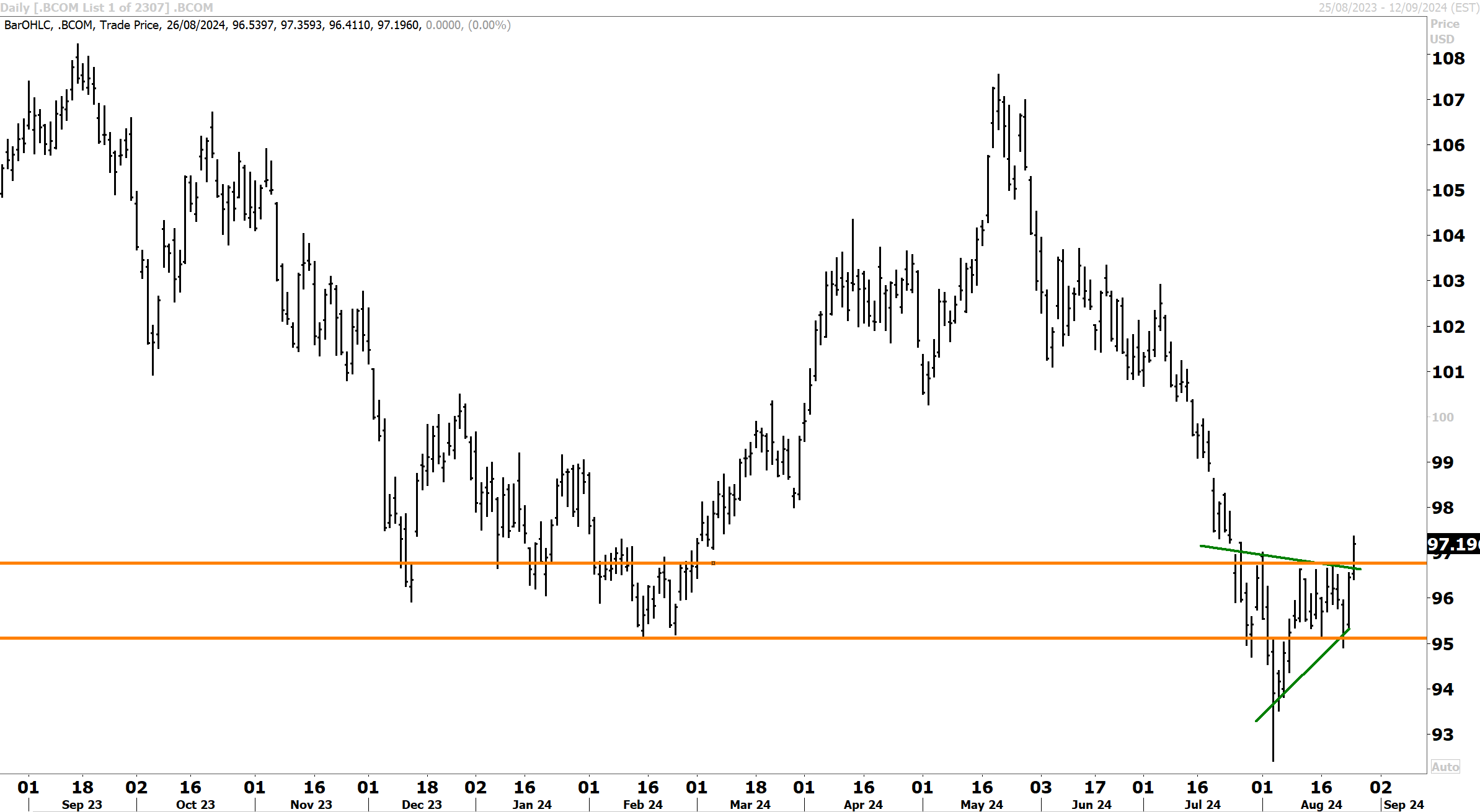

Commodities continued to be bought because of the weaker dollar. Crude prices lifted 3%, with WTI and Brent closing at $77 and $81.2. The Bloomberg Commodity index added 0.8% to 97 and broke out above near-term resistance, which favours further upside extension (see below). Gold held near the record highs at $2545 while silver added +0.5% to just under $30. Copper also extended 0.5% higher to $4.26 a pound. Most of the base metals were firmer, while the soft ag complex continued to run higher.

First up, former Merrill Lynch and highly regarded chief economist David Rosenberg believes that the recent large downward labour-market revision are the latest sign that the US economy is heading toward a recession and the Federal Reserve is behind on interest rate cuts. Mr Rosenberg correctly called the 2008 recession and noted this week to clients that the downward revision to payrolls data by 818,000 for the twelve months to March ‘24 is the largest since the Great Recession, which he believes is trouble for the US economy because the Fed has remained too high for too long.

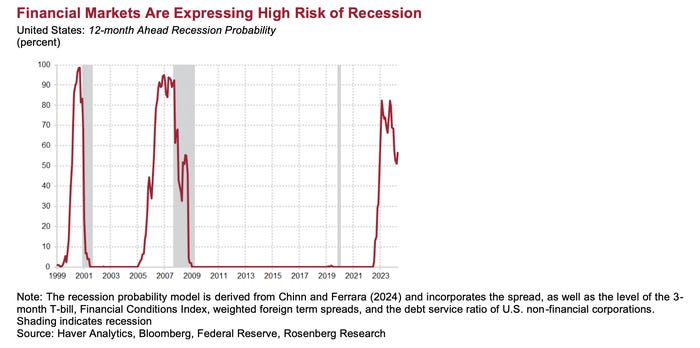

Jerome Powell played this down at the weekend, but the labour market data is going to be very influential to markets over the coming months. The Fed will also be sensitive to this and cognisant of the economic risks. Mr Rosenberg sees an economic slowdown approaching and has warned of a recession over the last couple of years. He cited two recession indicators, including a model that takes into account US businesses’ ability to repay debts and the Fed’s National Financial Conditions Index.

Mr Rosenberg noted that “while the indicator is dropping, it has risen to levels only seen in prior recessions. In those instances, the economy was only in recession after the index started declining. The measure currently shows a 57% chance of a downturn.”

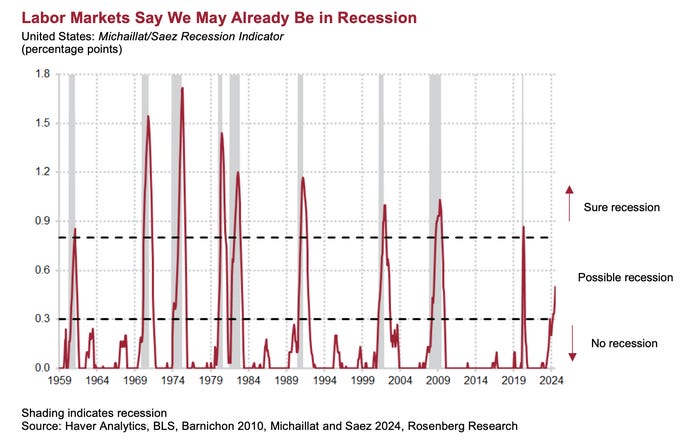

He also included a new indicator from economists Pascal Michaillat and Emmanuel Saez that seeks to build on the Sahm Rule unemployment indicator by accounting for job openings, which signal businesses’ appetite for hiring. The indicator is in “possible recession” territory and trending upward.

On valuation, Mr Rosenberg also said that US stocks were overextended, with the cyclically adjusted CAPE multiple at “35x, which is double the long-run average. Be that as it may, there are the fundamentals, and then there are ‘animal spirits,’ and sentiment over equities remains off the charts.”

However, I don’t see a hard landing for the US economy with the Fed now set to ease and dial down the monetary policy pressure. A soft-landing outcome is still very much the consensus view on Wall Street and amongst the major investment bank chief economists. But the cooling labour market does need to be paid attention to – and I think this heightens the risk of another leg to the corrective selloff that began in August. Preparing for further volatility in September/October is, therefore, a prudent course of action. The August lows could be retested by the benchmarks if there are any scares around the growth/soft landing narrative.

Moving on, Bank of America chief strategist Michael Hartnett told clients last week that “investors should do what central banks are doing…and buy gold.” He believes that “the interest rate cuts from the Federal Reserve that are coming could pose a risk to stoking a rebound in inflation next year…real assets, like gold, have historically performed well during bouts of inflation. Gold is the only asset that’s outperforming US tech shares.”

I think a big cycle has arrived for gold and precious metal mining shares.

Gold is extending higher in a consistent uptrend. There is no obvious resistance. What is remarkable is that the rally has not been accompanied by higher financial flows with the investing public largely absent.

While central bank buying has driven the gold price to new record highs, the next upward leg could come from financial flows as investors in the US and worldwide make a big return to the sector. The outflows we have consistently seen in the gold and silver ETF’s could soon reverse sharply, which is an argument I put forward some time ago.

Mr Hartnett cited this factor last week and highlighted that “the perplexing factor behind gold’s rally is that investors haven’t been chasing it. Instead, gold has experienced a net $2.5 billion in outflows so far this year, which means investors have been taking profits amid the precious metal’s record rally. That also means that the buying in gold has come from another cohort of the market. The juxtaposition of record-high gold prices and negative outflows is “explained only by unprecedented central bank buying. China’s central bank was the largest buyer of gold in 2023. Gold is now the 2nd largest reserve asset (16.1% versus the 15.6% held in Euros) and has one of the lowest correlations to stocks across asset classes.”

The Philadelphia Gold & Silver Index (of US listed precious metal miners) has rebounded dynamically off-key support and looks to challenge the historic highs at 165 in coming months.

Copper prices are looking better following the recent rebound back towards $4.30 a pound. JP Morgan noted that “downstream demand recovery is underway to drive a copper price rebound. High copper prices in the June quarter led to slower Chinese demand (but this was deferred not destroyed), resulting in higher-than-expected inventory levels. Inventory at SHFE has come down from ~350kt in early July 2024 to ~300kt in late July 2024 with downstream demand gradually recovering after a 20% correction in copper price. As fundamentals are getting back on track, we expect copper demand to improve further into September and inventory to decline further in coming months, triggering a copper price rebound as it gets to ~200-250kt levels.”

The correction in copper now looks complete. Whilst the correction that followed the record highs was steep and pronounced, copper’s technical setup continues to skew to the bull side. The upward dynamic off key support is encouraging, with scope now raised for a recovery back into the mid $4 range.

JP Morgan noted that “risk reward is getting more attractive. Copper stocks have pulled back 20-30% from their YTD peak. We are positive, but we think investors should be selective for the next copper price rebound and recommend names that could offer volume growth”. I continue to advocate the Global X Copper Miners ETF (ASX:WIRE, US:COPX) which provides a diversified basket, Evolution Mining (with around 30% of revenue to come from copper), and 29 Metals. BHP and Rio also look to be an opportunistic to get exposure despite near term price risks with iron ore.

Carpe Diem!

Angus

Disclosure: Fat Prophets and its affiliates, officers, directors, and employees may hold an interest in the securities or other financial products relating to any company or issuer discussed in this report. Fat Prophet’s disclosure of interest related to Investment Recommendations can be provided upon request to members@fatprophets.com.au.

Chart Source: Thomson Reuters