Good morning,

Stocks and bonds rallied Friday after Jerome Powell confirmed in a dovish speech the path was clear for rate cuts to commence in September. Mr Powell said that the “time has come”, leaving no further doubts that the Fed now has an easing bias after mentioning that the Fed was cognisant of a “cooling labour market”. He also acknowledged the recent progress on inflation and reiterated that the economy was growing at a “solid pace, ” pushing back on the growth scare narrative. Meanwhile, tensions surged in the Middle East after Israel bombed Lebanon in a pre-emptive strike.

The S&P500 rallied 1.15% to 5,634; the Nasdaq added 1.47% and the Dow Jones was up +1.14%. Futures markets are pointing to a solid start in Asia this morning, with the SPI indicating a +0.5% open. Sentiment was buoyant following Powell’s speech, with high confidence that the US economy would avoid a hard landing and that growth would continue into next year. The consensus view is that the Fed is doing whatever it can to prevent a pronounced slowdown, which means there is a good case for consistent easing, and I still expect three cuts of 25 bps each by year-end.

Bonds rallied across the curve, with yields falling 9 bps to 3.92% and the 10yr lower by 5 bps to 3.8%. The US dollar index declined sharply by 0.82% with significant gains in the euro, pound, and yen while the A$ is pushing up towards 68c. The DXY has fallen sharply to now test the big support level at 100. While a near-term rebound could ensue, given the dollar is now oversold, the big technical support level at 100 looks increasingly vulnerable in the coming months.

Commodities surged on Friday, with the weaker US dollar providing a tailwind. Oil led the rally, with WTI and Brent rebounding +2.5% to $74.80 and $79, respectively. Rising tensions in the Middle East helped boost prices. Gold added +1.2% to $2,546, while silver rose +3% to $29.80. Copper continued to firm, adding +1.25% to $4.24, while other base metals were higher across the board. Soft ag was also firmer, with solid gains in soybeans +3.5% and sugar +3%.

The weakening dollar should soon provide a tailwind for commodities, while gold has benefited for some time, reaching new record highs. After a sharp correction, the Bloomberg Commodity index looks to have bottomed out at key support at the 96 level. Should the dollar weaken further into the end of the year (our base case), I expect the Bloomberg Commodity index to recover significantly. An important inflection will be confirmed if the BCOM can sustain a breakout above 100 and advance above resistance at 107.

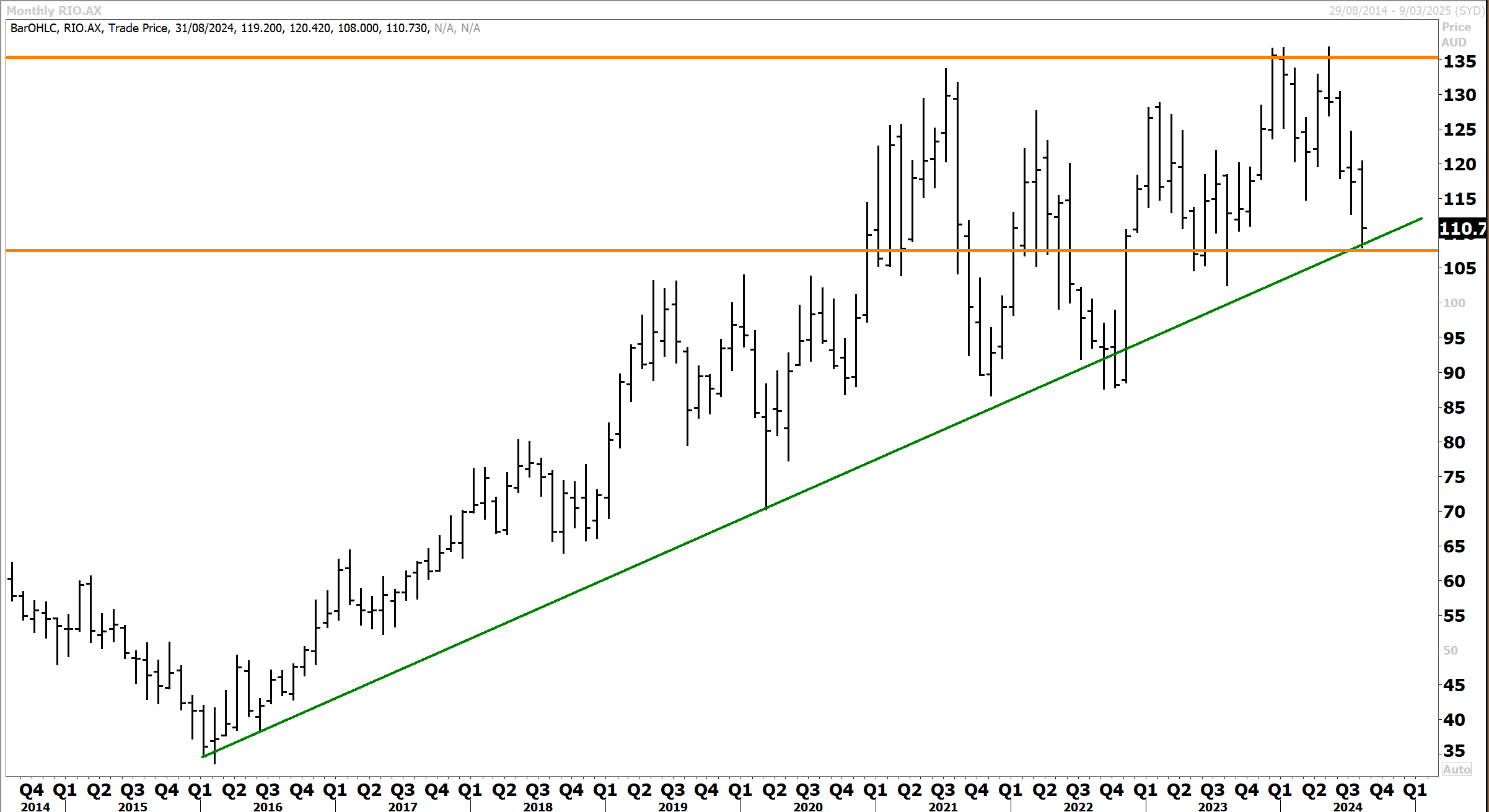

The large-diversified miner’s BHP and Rio look to have already established important bottoms. Rio has corrected from the record highs above $135 but appears to be now finding and holding above key support at the primary uptrend. Solid support between $105 and $107 should contain near-term downside risk, with our technical base case for a dynamic rebound and recovery up towards the record highs by year-end.

The S&P500 has recovered quickly from the early August selloff, now pushing up against the record highs above 5,630. While the prospects of a strong finish to the year and new record highs are promising for the benchmark, near-term risks are once again elevated heading into September & October, which are seasonally the weakest months of the year.

Valuations are high, as are consensus expectations around earnings for the September quarter, while the labour market is deteriorating. Growth could also be questioned, given the high bar of expectation around earnings. Any weaker-than-expected data print (especially around jobs) would quickly raise concerns the Fed has fallen behind the curve.

In a Bloomberg interview over the weekend, Morgan Stanley’s chief strategist Mike Wilson said, “It’s about the labour data, period — that’s going to dictate what the Fed does, they’ve said that. And that’s what the market is going to trade off.” Mike Wilson sees the September jobs data for August taking on heightened significance.

“If we get another negative number, the market can react as bad as it did in July at the index level. However, a very strong payroll number could reverse that trend back to more cyclical parts of the market”. Mr Wilson called the 10% selloff in US stocks back in early July, and I think he could be prescient again over September and October.

Given valuations are now very high, the risk/reward skew is unlikely to favour another 10% on the topside into September/October (if the labour data is favourable). However, we could easily see the early August lows retested should the data be adverse. I don’t see a bear market, but the markets are not out of the woods yet regarding correction risk. If a correction ensues, I expect the lows to likely be established by mid-October. Any selloff would, therefore, open a buying opportunity.

Carpe Diem!

Angus

Disclosure: Fat Prophets and its affiliates, officers, directors, and employees may hold an interest in the securities or other financial products relating to any company or issuer discussed in this report. Fat Prophet’s disclosure of interest related to Investment Recommendations can be provided upon request to members@fatprophets.com.au.

Share The Webinar

Related Posts

Achilles Heel

Key themes and stocks discussed today: Wall Street benchmarks reversed earlier gains to close sharply lower, with much of the late session selling coming in technology. Nvidia and Tesla accounted…

Read More