- US benchmarks finished modestly in the green as investors moved to the sidelines ahead of the highly anticipated Nvidia result due tomorrow. The key PCE inflation gauge is due on Thursday. Both results will set the market pace this week, although the PCE gauge will likely confirm the disinflationary trend. There is more uncertainty around the Nvidia result, which will set the pace for the semiconductor and tech sector, and sentiment generally.

- Bonds were steady while the US dollar continued to decline, retesting the August lows. A softer US dollar supported precious metals and commodities while oil prices retreated.

- In terms of what the Fed does next month, JP Morgan economists see the Fed cutting by 50 bps in September and November, followed by 25 bp cuts through to mid-November. This would be an aggressive pace of easing by the Fed. JPM believes the Fed will be on this path due to the slowing global economy, led by a mid-year stalling in Chinese and European growth, and that disinflation is accentuated in the US, with a sharp retreat in core inflation seen this year.

- JP Morgan strategists also noted this week that “equities no longer are a one-way upside trade, instead increasingly a two-sided debate on growth downside risks, Fed timing, crowded positioning, rich valuation, and rising election and geopolitical uncertainties. While the market focus in the first half was largely tied to the path of inflation, the second half focus is quickly turning to growth risks given elevated earnings expectations for 2H24 (+9%) and 2025 (+14%).” Staying defensive and holding some cash is prudent as we head into September and October.

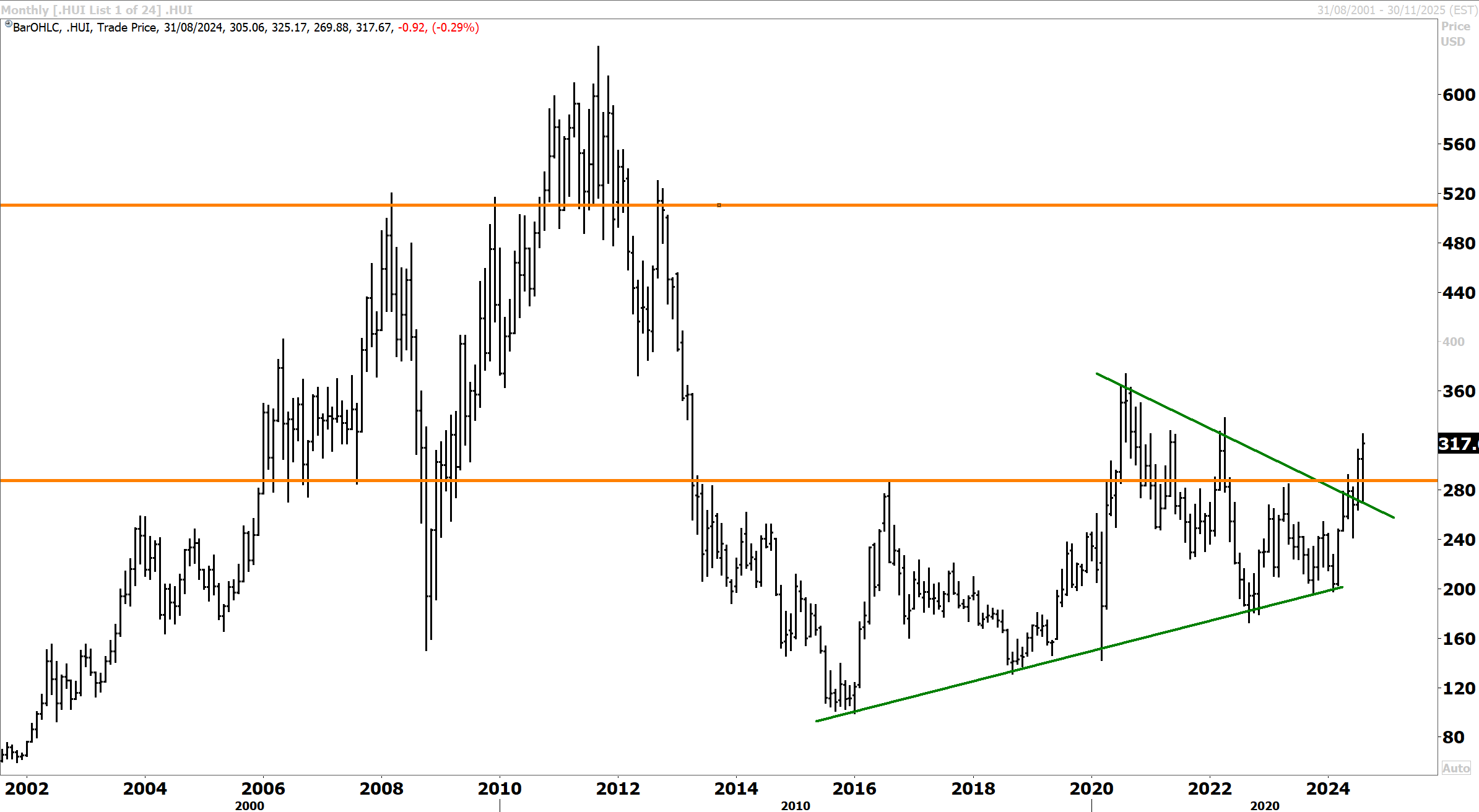

- Should the Fed cut by that magnitude in the months ahead, the economy would be immediately cushioned, which adds to the soft-landing narrative that the US will avoid a recession this year. Deeper rate cuts could see more downward pressure on the US dollar index – which is retesting the lows. Meanwhile, laggard gold and silver miners could be poised for a significant catchup rally.

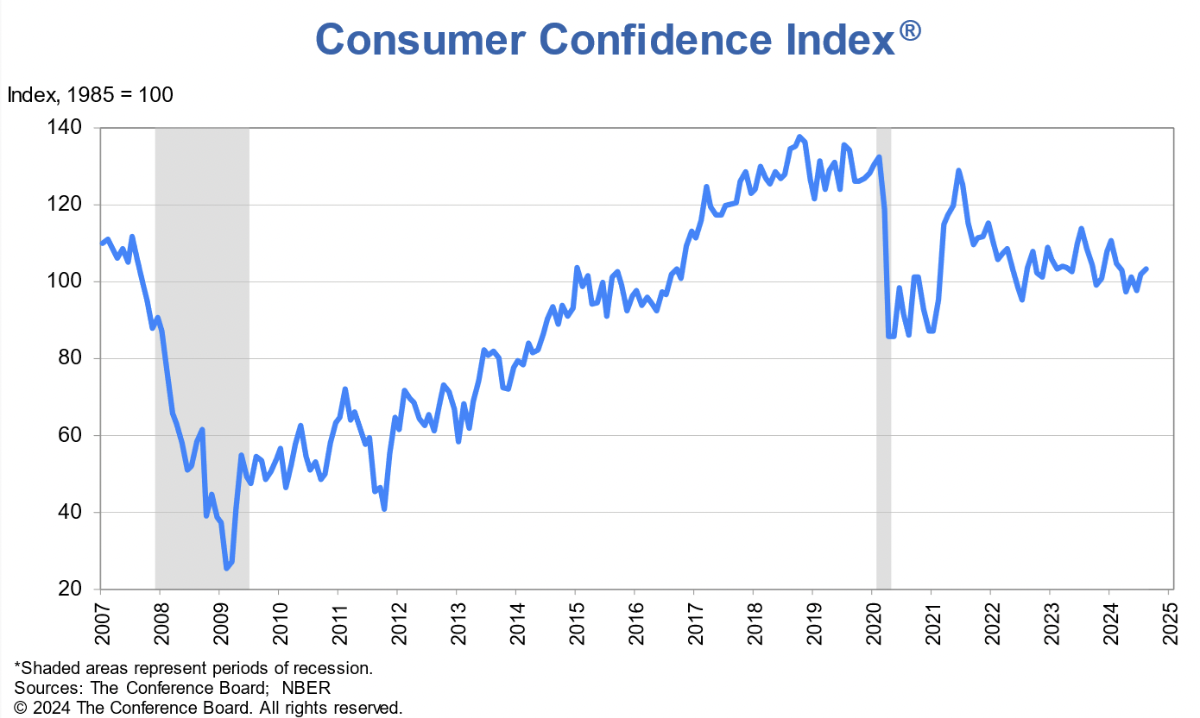

- The Conference Board’s consumer confidence index improved to a six-month high in August. Consumers feel more upbeat about the economy and inflation, which offset increasing concerns about the job market.

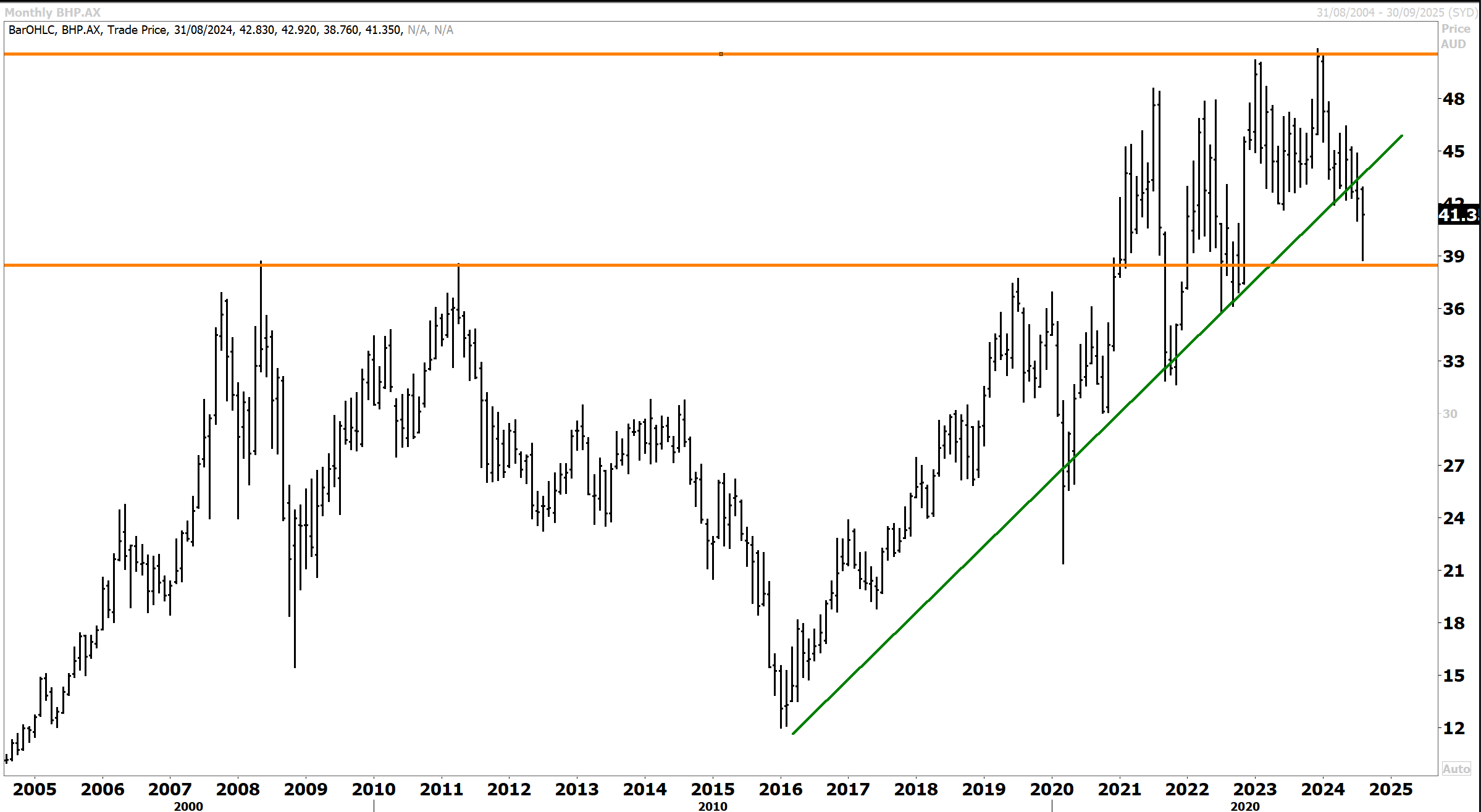

- The ASX 200 dipped as traders absorbed another wave of corporate reports, with more misses than hits. I fear that the economy is already in recession. Pressure will be mounting on the RBA to cut by year-end, in my view. Today’s inflation print will be insightful as to where the CPI is headed. BHP CEO Mike Henry gave an upbeat outlook following yesterday’s solid profit result.

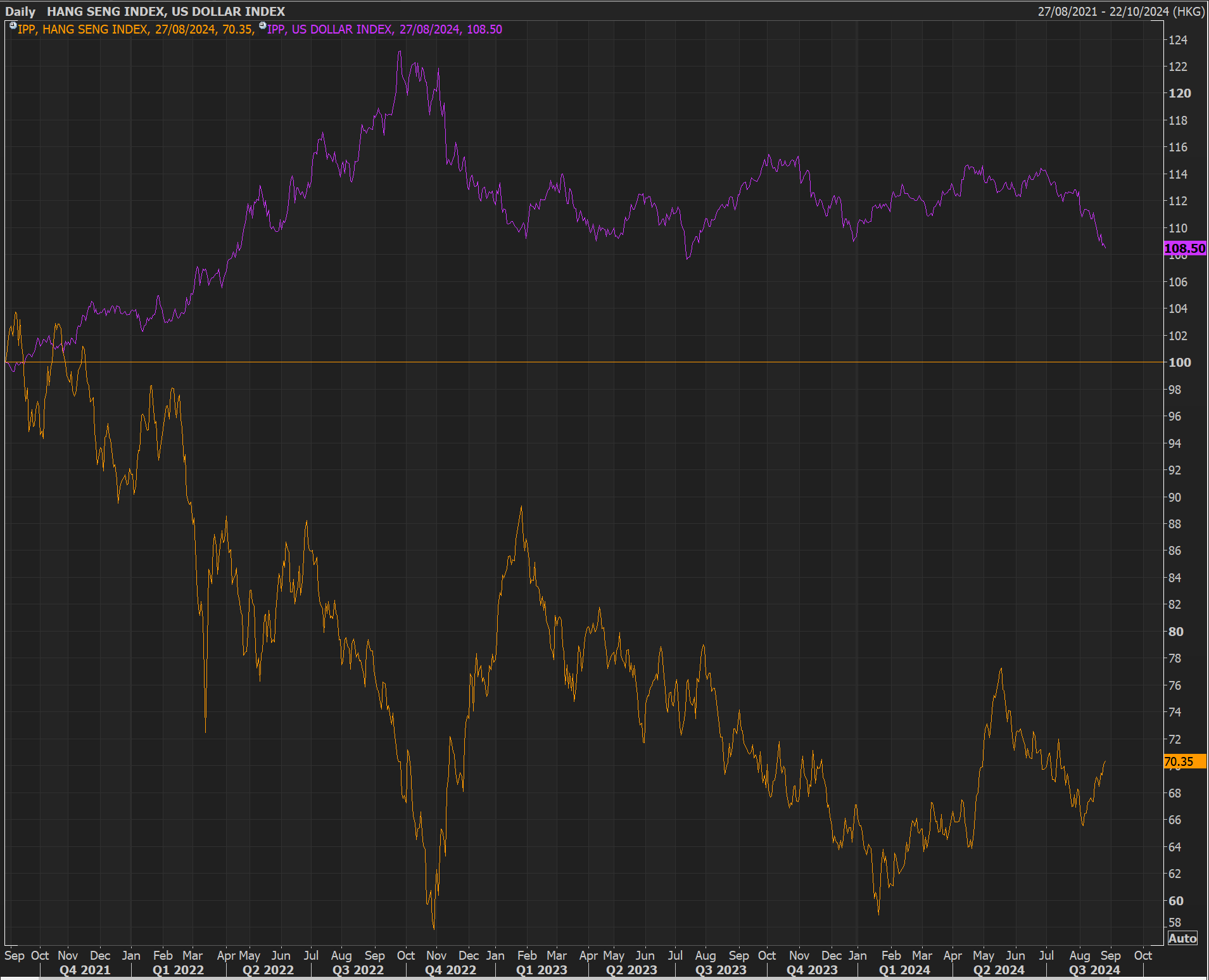

- Japanese benchmarks advanced as exporters benefitted from a weaker yen, although tech stocks tracked American peers lower to curb the overall advance. The Hang Seng gained as energy and consumer stocks rose.

- The FTSE 100 edged higher as UK shop prices recorded their first deflation in almost three years. UK Prime Minister Starmer warned of a £22 billion budget gap and said the Autumn budget would be strict to tackle the shortfall.

- European regional bourses were modestly higher despite mixed economic data. The recovery from the early August sell-off has been robust.

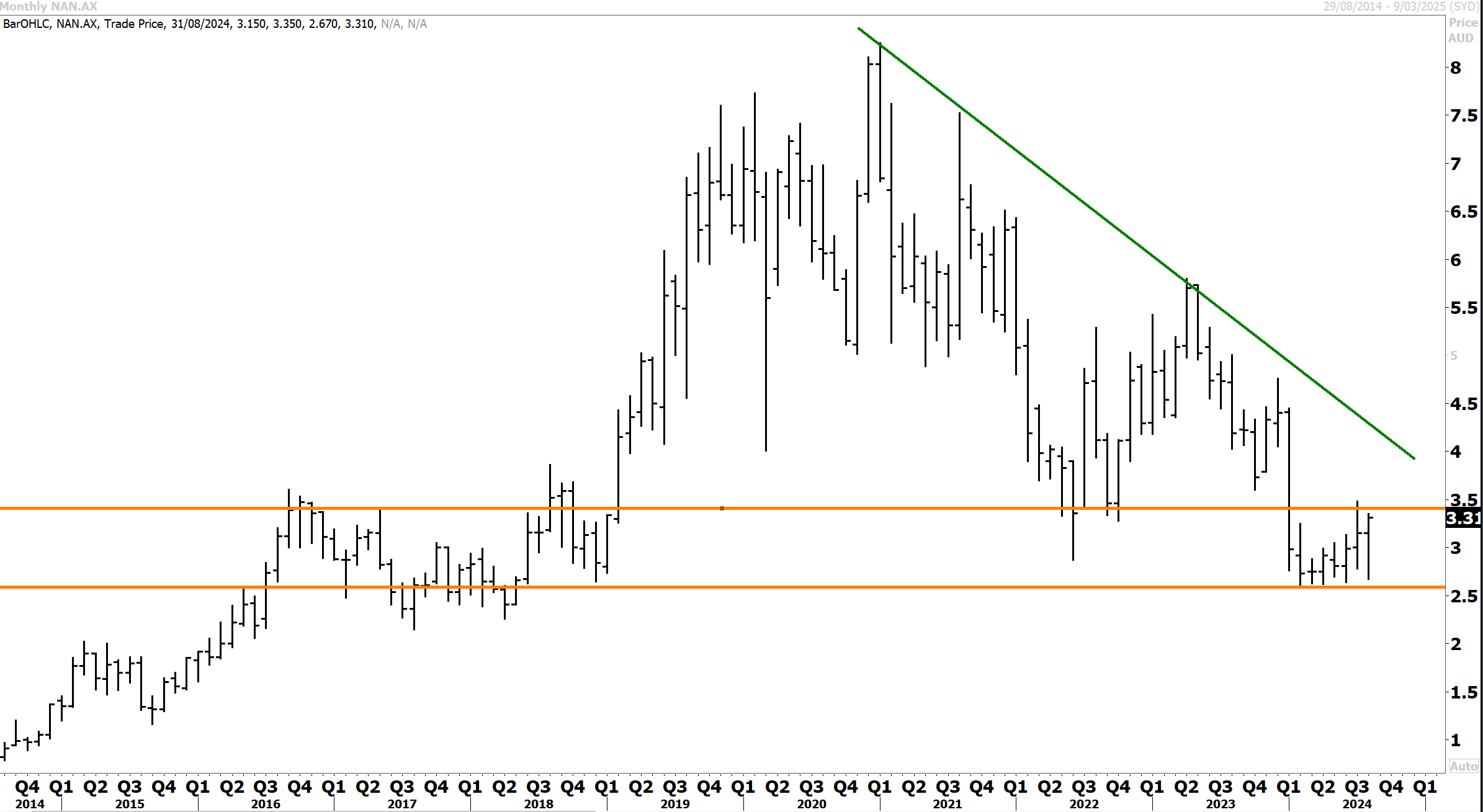

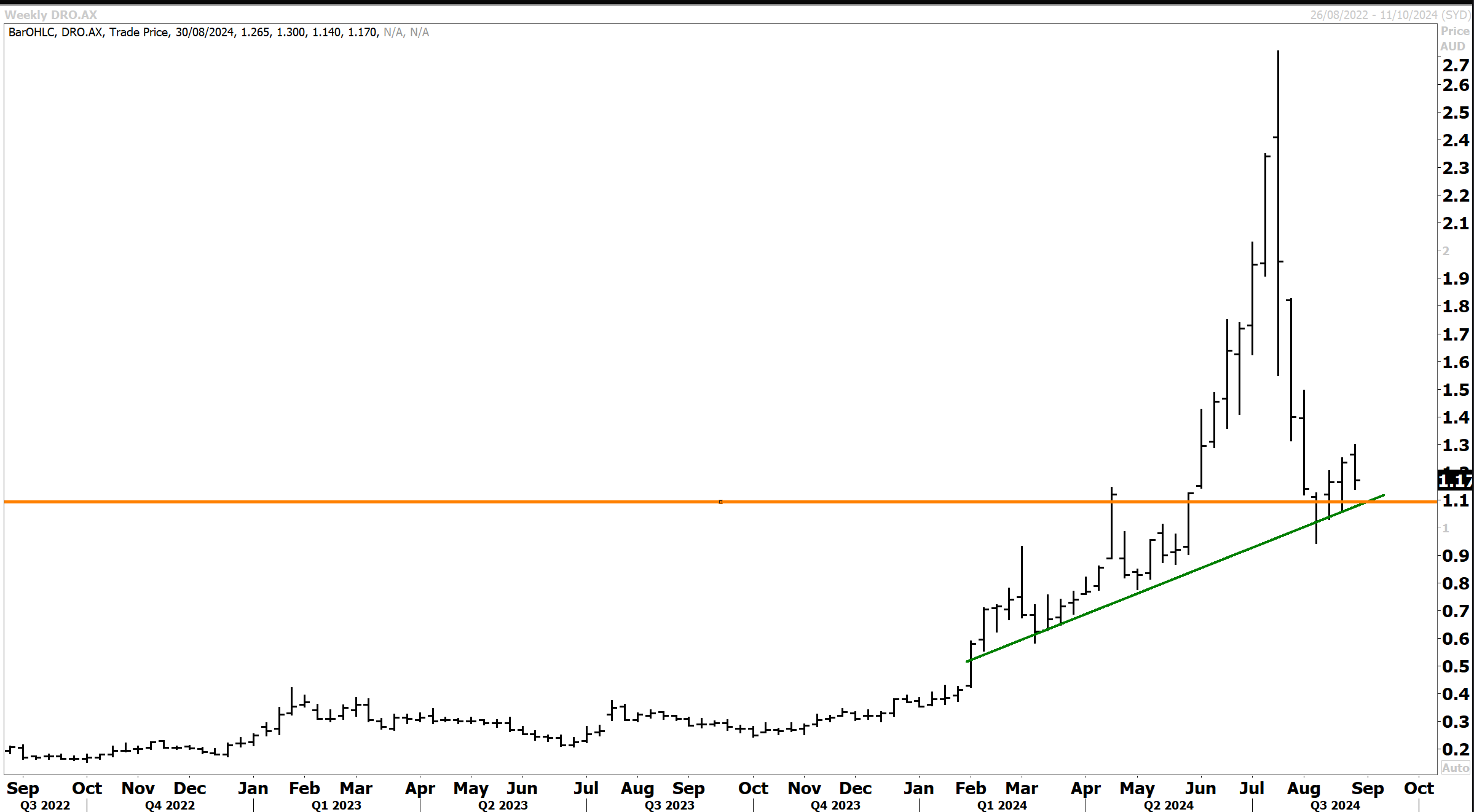

- Notable charts and stock mentions today include the S&P500, Dollar Index, Hang Seng relative to the DXY, ARCA NYSE Gold BUGS index, Silver, Sony ADRs, Nvidia, Resmed, Insulet, Royal Caribbean, Trip.com, Bunzl, JD Sports, BHP, Woodside, Droneshield, Nanosonics, Worley, Lovisa, Zip Co, SBI Sumishin, NetEase and Coeur Mining.

Good morning,

US benchmarks finished modestly in the green as investors moved to the sidelines ahead of the highly anticipated Nvidia result due tomorrow. The key PCE inflation gauge is due on Thursday. Both results will set the pace for the markets this week, although the PCE gauge will likely confirm the disinflationary trend. There is more uncertainty around the Nvidia result, which will set the pace for the semiconductor and tech sector, and sentiment generally. Bonds were steady while the US dollar continued to decline, retesting the August lows. A softer US dollar supported precious metals and commodities while oil prices retreated.

The S&P 500 was higher by 0.16% to 5,625. The Nasdaq gained 0.16% while the Dow Jones added a marginal 0.02%. The Russell 2000 underperformed with a 0.7% decline. Nvidia’s result will be influential because there is a high bar to clear regarding earnings and guidance in the coming quarters. The profit result will spotlight the AI sector, how the rollout is travelling generally, and, importantly, whether the billions being invested within the industry are close to generating a return on investment.

Bonds were steady across the curve ahead of the key PCE gauge due Thursday. This is the Fed’s preferred inflation measure, and a benign print will seal the rate cut expected in September. The issue now for the markets is not so much when, but by how much and what the path of future cuts optically is going to look like.

Futures markets favour a 25 bp cut, but 50 bps cannot be ruled out either, depending on how the labour market is shaping up. A rising unemployment rate could spur the Fed into making a deeper cut. Meanwhile, UBS raised the odds of a US recession to 25% from 20%, citing weakness in the labour market. The Dollar was weaker against all the major currencies, while the VIX dropped 4.5% to 14.5.

Commodities received a bid with the further weakness in the US dollar. Comex gold futures made a new record high at $2560oz, while silver rose 0.5% to $30. Base metals continued to rally with copper adding 0.5% to $4.30. Soft ag was stronger across the board. The softer US dollar is making commodities cheaper in other currencies, boosting demand.

In terms of what the Fed does next month, JP Morgan economists see the Fed cutting by 50 bps in September and November, followed by 25 bp cuts through to mid-November. This would be an aggressive pace of easing by the Fed. JPM believes the Fed will be on this path due to the global economy slowing led by a mid-year stalling in Chinese and European growth – and that disinflation is accentuated in the US with a sharp retreat in core inflation seen this year. JPM highlighted that “the US remains the global growth engine for 2024 but the slowing in the labour market will continue to weigh on income gains and layoffs are likely to rise from here. That said, recent activity indicators have assuaged growth concerns, and an imminent recession looks highly unlikely.”

Should the Fed cut by that magnitude in the months ahead, the economy would be immediately cushioned, adding to the soft landing narrative and the US will avoid a recession this year. Deeper rate cuts would be a supportive outcome for stocks. However, some might see this as the Fed acting to avoid the risk of recession. Between now and the end of the year – i.e., September/October- I expect some volatility to return around uncertainty with the soft-landing narrative as investors question the significant earnings growth now priced in.

For the SPX to break through to new record highs and reassert to the topside, Nvidia needs to deliver a blowout earnings result. While this is plausible, the bar of expectation is very high. Nvidia’s profit result will also call into question the billions invested by the tech sector in AI and the timing around just when a return on investment will be achieved. Sentiment around Mag7 and AI names will therefore be tied to the result, with obvious implications for overall market direction over the next few weeks.

JP Morgan strategists noted this week that “equities no longer are a one-way upside trade, instead increasingly a two-sided debate on growth downside risks, Fed timing, crowded positioning, rich valuation, and rising election and geopolitical uncertainties. While the market focus in the first half was largely tied to the path of inflation, second half focus is quickly turning to growth risks given elevated earnings expectations for 2H24 (+9%) and 2025 (+14%).”

JP Morgan strategists make a fair point about being relatively defensive over the coming months. Positioning amongst investors has become extreme following this year’s rally. Many sectors of the market (tech) exhibit crowding by investors that historically leads to more volatility. The big volatility spike in the VIX earlier this month, is unlikely to be repeated – but that doesn’t mean equity benchmarks wont retest the early August lows.

JPM cited that “while the recent market flush took out some of the froth, equity positioning and valuation still remain at risk especially if growth continues to decelerate and the Fed does not show urgency. Our house view expects the Fed to cut 50bps at both the September and November meetings followed by 25bps cut at every meeting thereafter. Historically, the start of FOMC easing cycles coincided with negative performance for risky assets.” It would be hard to see how markets would not get nervous by rate cuts of those magnitude and question high valuations currently priced into US equities along with aggressive growth forecasts. While I still believe the Fed will ease at a more moderate pace – 75 bps to year end, JPM makes a fair point about overall market conditions and the potential for a market reset in coming months.

Our high conviction ‘call on dollar weakness’ this year is finally beginning to play out. If JP Morgan is correct about the Fed cutting

Carpe Diem!

Angus

Disclosure: Fat Prophets and its affiliates, officers, directors, and employees may hold an interest in the securities or other financial products relating to any company or issuer discussed in this report. Fat Prophet’s disclosure of interest related to Investment Recommendations can be provided upon request to members@fatprophets.com.au.