According to Blackstone President Jon Gray, “the worst of the commercial real estate turmoil looks to be over”. Mr Gray said that he is cautiously optimistic on the outlook for the commercial property after several years of big declines, and notably in office. Blackstone is the largest owner of commercial real estate globally, with assets across various sectors including logistics, housing, data centres and hospitality.

Mr Gray said that the “tide may be turning”, which is “evident in a handful of signs flashing in the market similar to those that signalled a bottom in 2009, when the commercial real estate sector was beginning to rebound after the Great Financial Crisis. We said in January, publicly on earnings, that we thought commercial real estate was bottoming. And we’ve continued to believe that. We began to get those signals at the end of last year saying, look, the markets are recognizing inflation coming down. The Fed’s starting to tilt toward a different cycle. As the cost of capital comes down in these sectors, we should go out there and get it.” Mr Gray is notably worth listening to given not only the size and scale of Blackstone’s global property business, but that the manager notably exited the office market last decade.

Commercial property has underperformed by the largest degree since central banks around the world commenced a tightening cycle. Mr Gray went on to say that the “state of the market mirrors 2009, when activity in the sector was just starting to pick up after the GFC. And the problem for investors is they’re often looking in the rearview mirror. So, they’re saying to themselves, ‘Real estate, oh, I got all this troubled real estate. And I don’t want to go back into that. But if you went back to 2009, the best investments in the cycle were then. You didn’t get the “all clear sign” from everybody else till 2012.”

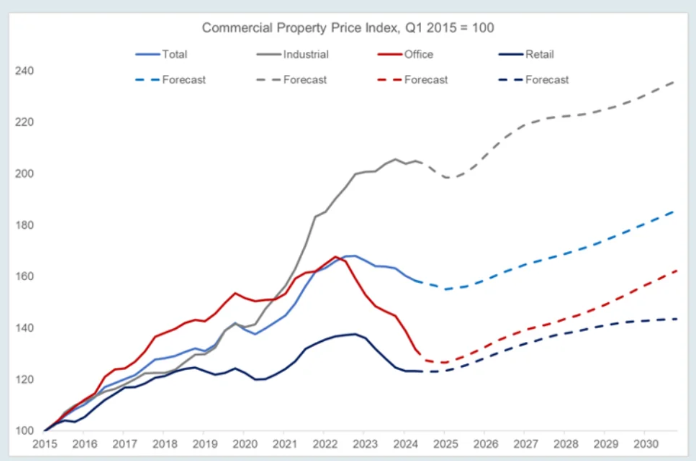

The commercial real estate market is poised to recover with a new central bank easing cycle

I bought commercial office property in Sydney back in 2010/11 when values were bottoming out at almost late 1980s prices. I recall going to auctions and being the only bidder in the room with a hand up. Sentiment was very bearish and depressed. And then the subsequent rebound off the bottom caught everyone off guard in Sydney, as prices climbed nearly fivefold.

According to Jon Gray, Blackstone has been busy deploying capital this year, and the firm has been scooping up logistics assets in Europe like buildings involved in storing and transporting goods, as well as real estate in Asia. “If you were an investor in real estate after the financial crisis, you would have made a lot of money. And my guess is, if you’re an investor today, the same thing will happen”. I think the big opportunity today in Australia is in office property which is price depressed in a similar fashion to 2010. The coming easing cycle by the RBA will likely see many B grade office blocks repurposed (into residential) given Australia’s housing crisis.

Carpe Diem!

Angus

Disclosure: Fat Prophets and its affiliates, officers, directors, and employees may hold an interest in the securities or other financial products relating to any company or issuer discussed in this report. Fat Prophet’s disclosure of interest related to Investment Recommendations can be provided upon request to members@fatprophets.com.au.

Chart Source: Thomson Reuters