Welcome to the Fat Prophets User Manual. We suggest you take a few minutes to read this document as it will assist you in maximising the benefit of your Fat Prophets Membership.

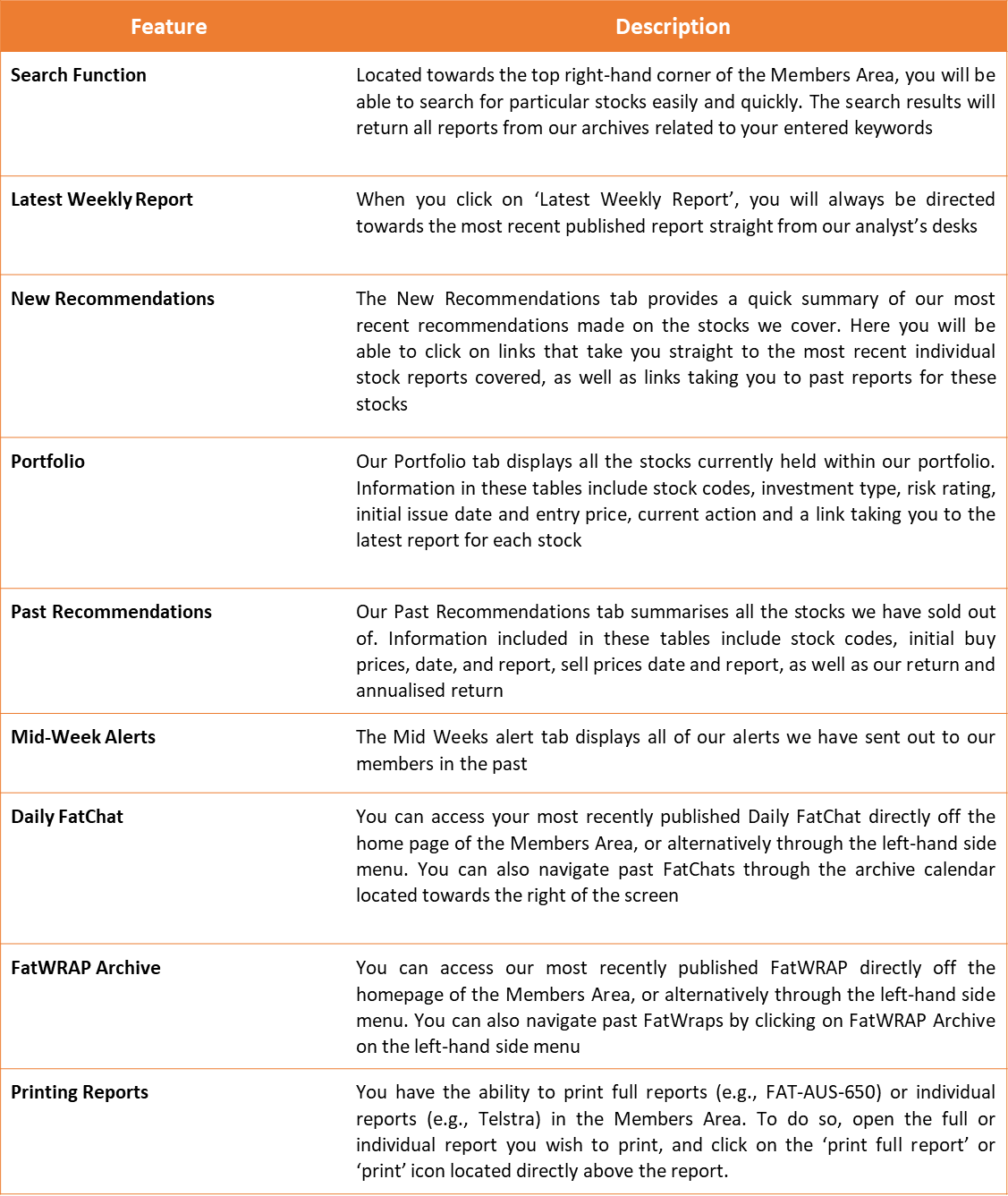

The User’s Manual is a guide for Members on how to apply the Fat Prophets report to a share portfolio. The manual also contains useful information regarding the website, archives and how to access the report on a weekly basis. Fat Prophets is different to most other services in that every recommendation is branded with a particular ‘label’ to assist Members in determining the suitability of a particular stock. You will find an explanation of these ‘labels’ within the manual, along with a description of the different risk profiles that accompany each recommendation.

The User’s Manual also establishes the ground rules for the Fat Prophets Portfolio, and what happens after a recommendation is made. Every recommendation made by Fat Prophets can be easily referenced in the FAT archive section of the Members area. It is our intention to make our recommendations as transparent and accountable as possible, regardless of whether a stock is profitable or not. We believe that Fat Prophets is one of the first advisory services in Australasia to achieve ‘transparency’ of this clarity.

Stock Market Fluctuations

Members should note Fat Prophets predominantly applies a value oriented investment style, with the typical holding period often being more than twelve months. From both a fundamental and charting perspective, we generally adopt a medium to longer term horizon when making recommendations.

On occasions the timing of our recommendations is wrong, and a stock could typically fall by 10 percent or more. In most cases this is of no great concern, provided the underlying fundamental value of the company remains intact. In these situations, we aim to maintain exposure to the stock (with a hold recommendation) until such time as the price action improves. In many such instances, further buy recommendations will be made if we perceive the opportunity as being favourable.

When a company’s underlying financial position is sound and intrinsic value is obvious, the share price will typically recover at some point in time to reflect fair value. We generally only recommend selling an underperforming stock if the value assumption no longer holds true.

As famed stock market investor Warren Buffet has often said, “You are neither right nor wrong because the crowd disagrees with you. You are right because your data and reasoning are right.” Caltex is a prime example of this. After our initial recommendation in 2001, the oil refiner traded lower for an extended period losing 50 percent in value before going on to more than double from the initially recommended price.

Despite the sizable loss that followed the first buy recommendation (other buys followed at opportunistic lower prices), we remained firmly of the opinion that Caltex was trading significantly below fair value. This view was ultimately vindicated during 2002 and 2003 when Caltex went on to become one of the best performing stocks on the ASX. In our experience, patience is a key element to successful investing.

Buy/Sell Recommendations

It is worth highlighting that buy recommendations are only made when the right opportunities surface. In the event of there being no suitable buy recommendations for a given week, we will provide Members with both updates to existing stocks within the Fat Prophets portfolio and macro overview pieces. Being patient and waiting for the right opportunity is important when investing.

When a buy recommendation is made a price level will always be given where we think the stock should be bought up to. This level represents the maximum price that Members should pay when placing buy orders. If you are unable to buy the stock at the recommended level we suggest leaving a bid with the broker and being patient.

Most stocks will trade above and below the recommended buy price over the short term. With patience however, in most situations Members should be able to purchase stock at the recommended price.

On occasions, when a stock is thinly traded, we may use the terminology ‘Buy around $XYZ’. In this instance, Members should use discretion in fine-tuning their entry level. For hypothetical performance calculations, Fat Prophets will use the opening price the morning following the recommendation.

Once a sell recommendation is made, Members should aim to sell as closely as possible to the recommended price. For the purpose of tabulating our performance, in instances where the recommendation is to ‘Sell around $XYZ’, Fat Prophets will use the opening price the morning following the recommendation.

In order to indicate what action you should take on a stock, Fat Prophets uses the following symbols

Structure of a Portfolio

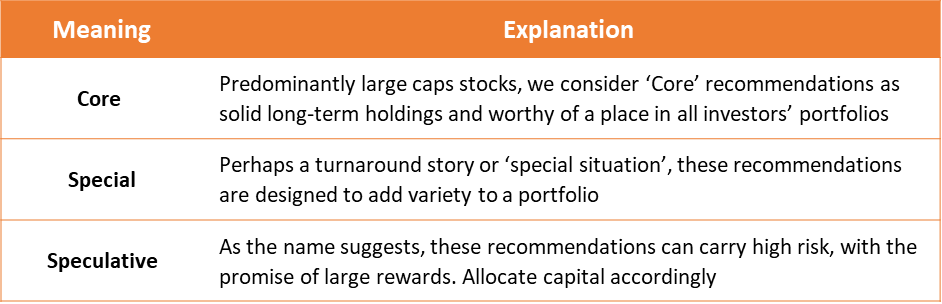

Fat Prophets is not licenced to provide specific portfolio construction advice for individuals. We can, however, provide guidance to the type of holding that we believe a stock represents. Below are meanings that we use to indicate what purpose a stock may serve in a portfolio:

Allocating Capital

With respect to allocating capital towards each recommendation, we believe the best approach is for Members to follow at least four or five stock ideas. The merit with this approach is diversification. Like the markets, Fat Prophets is not perfect and losses are unfortunately inevitable. However, with more irons in the fire there is potentially a greater chance of overall success.

We also recommend diversifying risk among different sectors, so as to avoid placing all eggs in the one basket. In order to keep brokerage charges down to a reasonable percentage, around $2,000 or £1,000 is the minimum amount we would generally suggest allocating to each particular stock. If this means you do not have enough capital to follow four or five ideas, we believe it is best to follow fewer stocks and keep your minimum investment to approximately $2,000 or £1,000.

It is important to remember that there is no pressure to buy the first recommendations that are made. We suggest being patient and taking some time to get an understanding of the Fat Prophets methodology. This will help ensure that the recommendations you choose to follow are the most suitable for you.

In order to help you select the most suitable recommendation, we ‘brand’ each individual stock idea. We also point out what we perceive to be the underlying risk factor.

Stop Losses

In our weekly equity reports, we do not use a set stop loss. This is for two reasons:

1) All of our Members have different tolerances to risk, and as such it isn’t possible for us to tailor a stop loss to suit everyone’s needs.

2) Because we are combining fundamental analysis with chart analysis, a fixed dollar stop loss is generally not appropriate (like it would be if we were using charts alone). Instead we will continue to recommend holding a stock as long as our underlying value assumptions remain valid.

Risk management is an important aspect to successful investing. In our opinion adhering to a strict stop loss is essential in some circumstances (for example where leverage or borrowed funds are involved) but more flexible in others (where diversified and well researched value investing is being applied).

We encourage members to diversify their stock holdings and not to place too much capital into high risk recommendations.

Can I ask for additional stock advice?

As a rule we do not provide advice outside of the report. Each of our recommendations are thoroughly researched and this takes up a significant amount of time and resources. Unfortunately from a time perspective we are simply unable to extend this to providing general advice on stocks not covered within the Fat Prophets Portfolio.

We encourage feedback about the report, and if there are any questions relating to a particular edition please email your query through to us. However please understand that we cannot comment on individual stocks outside of the Fat Prophets Portfolio.

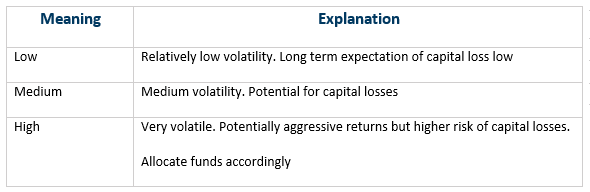

Risk Profile

Risk is a critical element when deciding whether a particular recommendation is possibly suited to you. While we know a number of our Members are comfortable taking on higher risk situations, we strongly believe that you should not have exposure to too many high-risk ideas at any one time.

There is always a likelihood that high-risk ideas will experience a significant degree of volatility. We feel the best approach for less experienced Members (and those who dislike the likelihood of extreme volatility) is to limit themselves to the low and medium risk ideas.

Please take note that there are significant risks involved when investing directly on the stock market and it is imperative that an investor has full comprehension of their own risk profile. We strongly suggest seeking the professional opinion of an investment advisor if you have any doubts over the suitability of a recommendation to your individual situation.

In order to make differentiating between the different risk profiles easy we again the three meanings below:

Password Assistance

When registering for Fat Prophets you will be either issued an automatically generated password or asked to choose one. Your access details are specific to you and MUST NOT BE TRANSFERRED to anyone. You can change your password by using the “My Password” function in the members area of the website.

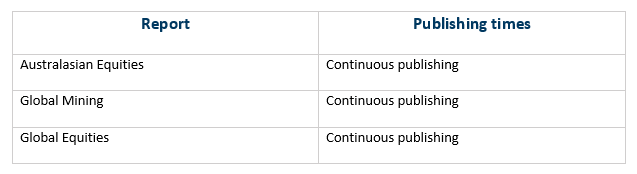

Publishing Times

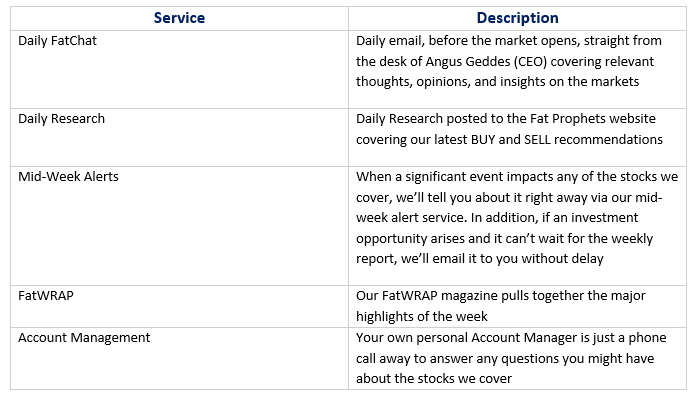

Fat Prophets Services

Fat Prophets Services