Much has happened over the course of just the last week with a number of key standout events shaping the course of where the markets are likely headed into yearend. Firstly, the solid labour market report which saw the US economy add 250,000 jobs well above consensus expectations has recalibrated lower the number of rate cuts priced into December. Bond yields rose across the curve as did the US dollar, whilst the S&P500 continued to grind higher making new record highs.

Secondly, rising geo-political tensions in the Middle East pushed oil prices higher while gold and silver made new highs above $2700 and $32. We also saw a big rebound in key commodities including copper and iron ore, and a sharp recovery in the beaten down resources and materials sector.

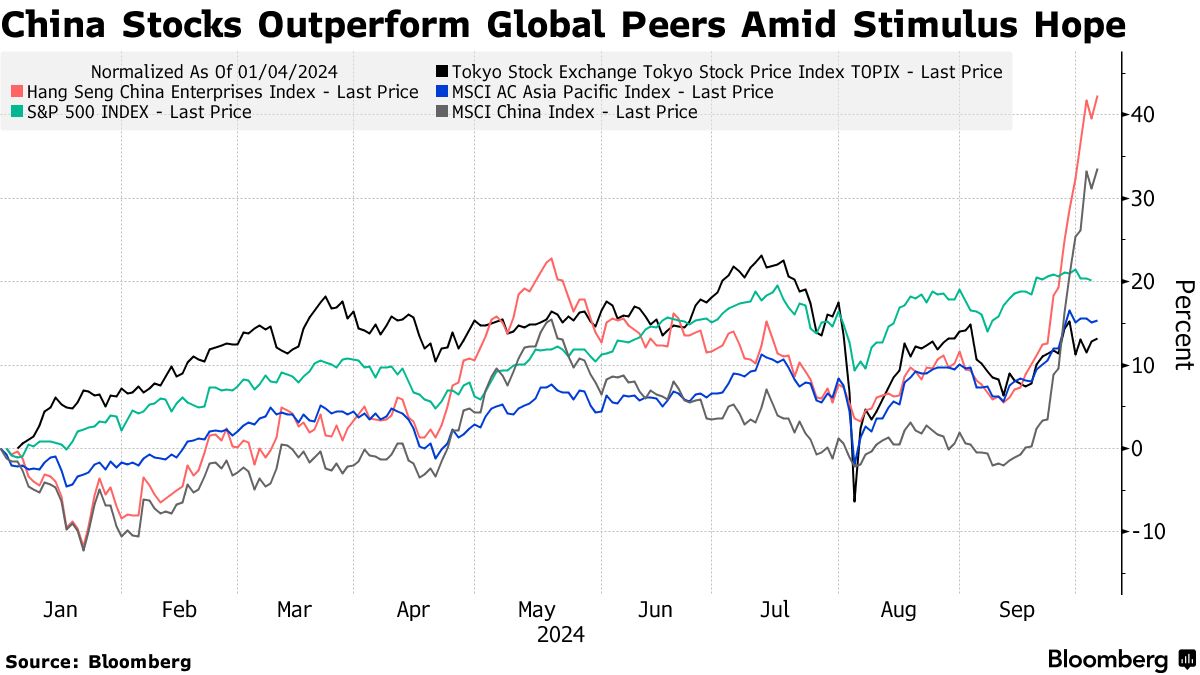

Third, China equities staged the most explosive rally in nearly two decades after

the Beijing pivoted on stimulus and now looks committed to follow through with another big round in coming weeks. The Hong Kong Hang Seng index surged to 23,000 over the past week and is the best performing market in the world this year. The mainland China stock market has been closed for the past week due to the public holiday and is set to reopen today.

On Monday, US benchmarks came under pressure with the big surge in bond yields finally beginning to take a toll as markets recalibrated expectations for lessor Federal Reserve rate cuts into year end with the US economy still very resilient and the labour market strong. Rising oil and commodity prices in the wake of fresh China stimulus could also concern the Fed that inflationary pressures could reassert. Rising conflict in the Middle East and escalating geopolitical tensions contributed to the risk off session on Monday which kept investors on the sidelines.

The Bloomberg Commodity Index has completed a continuation pattern, breaking out above resistance. Scope is now raised for a recovery towards 110. Rising commodity prices are one risk to the deflationary narrative, although for now the downward trend remains entrenched and will likely continue into next year.

The Dow Jones fell 0.94%, the S&P 500 declined 0.96%, to 5,696 while the Nasdaq Composite dropped 1.18%. The Russell 2000 declined 0.89%. The VIX meanwhile surged 18% to 23. The third quarter reporting season is just around the corner with the first batch of S&P 500 companies due to report over coming weeks. The banks will kick this off on Friday with a number of the majors set to report earnings.

Earnings will be a significant test for Wall Street with all the key benchmarks at record highs and with valuations skewed to the topside of the historical band. However, the US economy remains resilient and is still growing at a decent pace. Goldman Sachs raised their ‘24 year-end target for the S&P 500 to 6,000 from 5,600, and also lowered the odds of an economic recession to 15% from 20%.

The S&P500 has made new record highs above 5,700 with key supports now below this level and significantly so at the 5,200/5,400 levels that will be well defended. There is nothing technically that comprises the primary upward trend, albeit the S&P500 is fully priced in terms of valuation. I continue to see better value and significantly less risk in other markets including Australia, UK, Japan and China/Hong Kong.

Barring a left of field event (i.e. a big escalation in oil prices due to broadening conflict in the ME), the S&P500 looks set to push higher into the end of the year along with most of the major stock markets. However, we could see a mild correction this month (which is seasonally volatile) ahead of the US election and as uncertainty around the outcome mounts.

US bond yields rose across the curve with the 10yr rising 6 bps exceeding the 4% level for the first time in two months. The 2 yr rose 8 bps to 4%. The bond market is now pricing in an over 83% chance of a 25 bp rate cut at the Fed meeting in November. The 50 bp rate cut that was priced in is now being ascribed a much lower probability in the wake of Friday’s stronger-than-expected non-farm payrolls data. In terms of catalysts, this week investors will be focused on the CPI index due out on Thursday where the disinflationary trend should be reaffirmed. Fed officials Neel Kashiri, Michelle Bowman and Raphael Bostic are due to speak.

The US10yr yield has bounced strongly off the 3.6% level to climb back into the middle of the range. The downward trend in US bond yields looks to have halted and been arrested for the time being. I would expect longer dated yields to remain range bound in the wake of last week’s solid nonfarm payrolls print and until after the election. Oil prices also need to settle down, but there is upside risk on this front with Hurricane Milton due to hit the Gulf of Mexico this week and escalating ME tensions.

WTI crude prices remain rangebound with the advance to $77.35 over the past week being the approximate mid-point. A sustained breakout above $80 however would raise scope for upside extension towards $90. If this outcome is realised, the markets could become uncomfortable given the disinflationary narrative would be jeopardised as would the rate cuts that have been priced in. Oil prices therefore merit watching closely over coming weeks.

In terms of the rest of the commodity complex, after making new record highs above $2700 gold corrected, falling 0.18% to $2666. Silver and platinum were also 1.5% lower on Monday. Copper prices were solid last week with the rebound pushing price levels back above $4.60 a pound. With more China fiscal stimulus likely coming, precious metals, base metals and iron ore should all remain strong into year end. We saw a notable rebound over the past week in the large cap diversified resource companies including BHP and Rio.

Iron ore prices rebounded dynamically last week off the primary uptrend which was always our technical base case. Iron ore’s primary uptrend that has been in place since 2016 has been remarkably consistent. The rebound last week is highly encouraging, and looks set to continue if China follows through on additional fiscal stimulus (which I believe is very likely – more on this below).

Last week’s rise in US bond yields has placed pressure on the global bond market with yields rising around the world. Japanese bank stocks were however a key beneficiary yesterday with the Refinitiv Japan Bank index reasserting to the topside following a multi-month correction. Yesterday’s topside breakout above resistance is encouraging and raises scope for upside extension and a retest of the highs near 110 over the coming six months. Japanese banks are a decent hedge against rising bond yields’ and we remain overweight in the Fat Prophets Global Contrarian Fund.

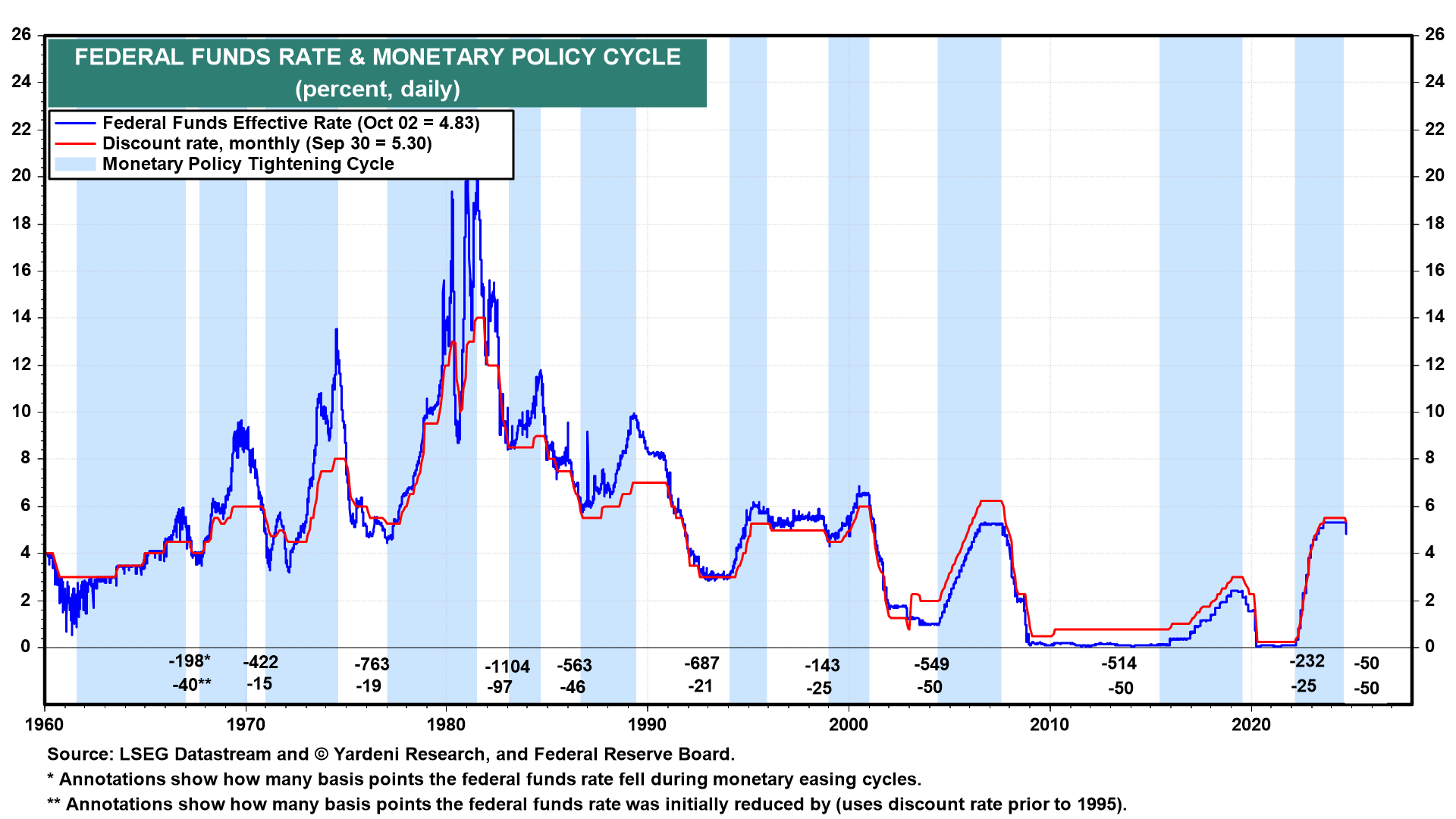

Moving on veteran economist Ed Yardeni believes that following Friday’s strong employment report, “the consensus might soon pivot to no rush to ease further during the fall. We can’t rule out ‘higher for longer’ making a comeback this winter. We are in the none-and-done camp for the rest of this year.” In other words, Ed no longer sees any further rate cuts into year end. This was also a point made by Stephen Schwarz, CEO of Blackstone who said in an interview on Bloomberg that believes “the market has been to aggressive in pricing in too much easing in the year ahead and the Fed will ease at a more gradual pace”.

Ed Yardeni pointed out that in the past, once the Fed started cutting it was followed by a quick succession of additional rate cuts (see chart below). “So far, the difference this time is that there’s no credit crisis, credit crunch, or recession. Instead, the economy continues to grow at a solid pace around 3.0% on a y/y basis. So there’s no rush for the Fed to ease, especially if the economy continues performing well.” This is a fair point, with the Fed consistently maintaining that it is data dependent.

I believe this is some risk around the future path of easing given the blowout jobs data, however there is still a good chance of one more rate cut once the November election is out of the way and particularly if the labour market shows any signs of weakness. I also agree with Ed in that whilst there is a risk off pushback on future rate cuts and the Fed holds “higher for longer”, this will only occur if the US economy remains very strong. The S&P500 is therefore going to be a beneficiary of strong growth, and our base case is still for a solid rally into year-end once the November election is out of the way.

Mr Yardeni also said this week that he “still expects the bull market in stocks will continue to broaden, but it is more likely to broaden from the Magnificent-7 to the S&P 493 than to the S&P 400/600 Small/MidCaps. As the economy continues to expand, more of the S&P 500 companies will show positive earnings growth.” He is less bullish on the more rate sensitive small/midcap stocks, which is a fair point.

Turning to China/Hong Kong, last week we saw the biggest rally in decades in Chinese stocks following a huge pivot from the Government. I believe that Beijing is now determined to do “whatever it takes” to shore up confidence within the economy ahead of the US election with additional tariffs likely coming no matter who wins. Beijing will now urgently seek to avert and arrest any further decline in the economy, which risks domestic political unrest.

One of big calls for this year that China/Hong Kong stocks would exit a bear market finally occurred with the CSI300 dynamically breaking out of a primary downtrend in place since 2021. The rally in the past four weeks has been explosive with the CSI300 surging over 30% after confirming a double bottom in recent weeks. The MSCI China Index is up by more than 34% year to date, surpassing gains for the US benchmark S&P500. Scope is now raised for a big recovery over the coming year and I continue to see Hong/Kong/China stocks outperforming the US and many other markets given the historically low valuations and the pivot with the Government on stimulus.

The Government now needs to follow through and ramp up fiscal stimulus (after the groundbreaking monetary stimulus delivered last week) and has ample fire power to do. In terms of debt to GDP, China’s ratio is around 80% (which is significantly below other nations) so there is plenty of scope to increase fiscal stimulus. I expect fiscal stimulus to ensue over coming weeks this month and ahead of the US election that will further underpin the rally in both the China mainland and Hong Kong stock markets. Near term risks a correction given overbought conditions, but any weakness will likely prove transitory. The bears were badly caught out last week and were left licking some nasty wounds. Any weakness will see many that are still short quickly get out and close down bearish positions.

On this front, Goldman Sachs predicts that the blowout surge in China’s stock market still has a way to go, “with another 15% to 20% upside ahead”. This is a big call given the +30% rally that has already ensued, and while I am cognisant of near term overbought conditions, there is no doubt in my mind that China/Hong Kong equities have now confirmed important inflections. We remain overweight these markets within our portfolios and will add to positions on weakness.

The bear market that manifested in China saw valuations become extremely depressed was never going to end quietly. I expect both the CSI300 and Hang Seng to extend much higher over the coming year with both indexes likely to climb amidst a “wall of worry” and widespread scepticism amongst many investors.

China/Hong Kong equities remain under owned by the broader investor community and global funds which provides the fuel for a much more extensive rally over the medium turn and the bears throw in the towel. Goldmans cited that “the significant gains in China/Hong Kong have been driven by two key factors: the catalyst of more substantial policy measures and the starting conditions of an oversold and under-positioned market backdrop.” So, under positioning and still very cheap valuations in itself can drive both Indexes higher.

The Hang Seng has surged +50% this year from the January lows at 15,000. Near term conditions are now overbought, which risks a correction at the resistance level at 23,000. However, the HSI is now in a new bull market with scope for a further big recovery in the year ahead. Valuations are still very cheap with growth likely to soon accelerate in China.

Goldman outlined four reasons to support its forecast of 15% to 20% upside for Chinese stocks. “First, valuations have room to expand if Beijing commits to its policy support. Even though they’ve recovered from a PE low of 8.4X forward earnings, valuations remain below a five-year mean of 12.1X. Fiscal easing often corresponds with expanding valuations”. There is ample scope for the average China/Hong Kong PE to expand after touching the historically cheap 8X earlier last month.

“Second, China’s recent policy announcements likely clamp down on investment risk. Before Beijing delivered its forceful stimulus blitz, the market’s implied cost of equity was elevated, indicating lingering concern about downside risk. China’s commitment to its new policies should ease this measure.” Sentiment is influential and everything in financial markets directly leading to over or under priced assets in a predictably repetitive pattern. The new stimulus measures go along way towards putting a floor under confidence.

“Third, earnings growth could pick up if the economy responds well to China’s latest support measures.” Goldman is optimistic in this outcome, estimating that the central bank’s policy easing could lift China’s GDP by 40 bps. “Our economists currently forecast GDP growth of 4.7% and 4.3% for 2024 and 2025 but note that the announced and indicated measures reduce downside growth risks inherent in recent monthly activity data.”

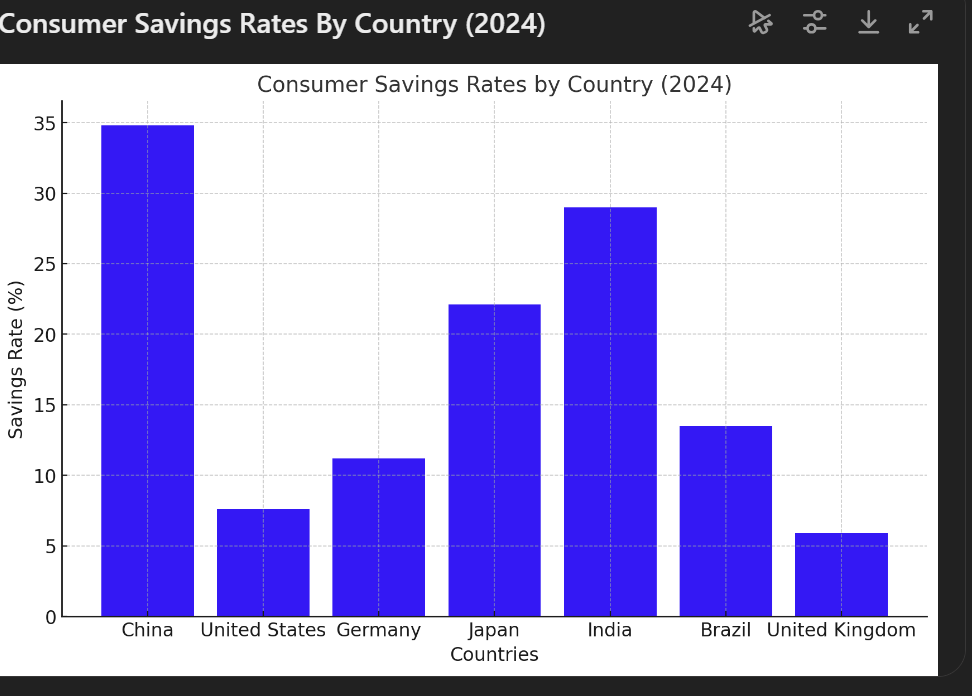

I would also add that Chinese consumers have the highest savings rates in the world amongst the worlds largest economies. Hoarding has occurred due to a lack of confidence around the economy, but the new stimulus measures and upside move in the stock market changes all this. Significant pent up consumer demand is likely on the cusp of being released further underpinning the recovery.

Finally, Goldman noted that “equity positioning is light, leaving room for more market entrants that could push stocks higher. With risk appetite returning to onshore and foreign investors, market participation is rising from low levels. But even as traders snap up Chinese equities, their exposure remains low. For instance, mutual funds were 310 basis points underweight China at the end of August, the rally’s jump-start only deepens this figure.”

I believe that a new bull market has begun in China with much further to run. Most investors did not see last week’s really coming and are very under positioned with little or zero exposure. Also as mentioned above, the bears and those short would have got a huge fright and will be looking to close down positions.

French bank Société Generale also expects an additional surge of 15%, “with another round of likely coming stimulus spurring a fresh economic growth spurt for the world’s second-largest economy. Chinese stocks notched their best week since the Great Financial Crisis after the measures were announced. And there’s likely more upside on the way, given that Beijing is likely to supplement the monetary support measures with increased fiscal spending next year”.

SocGen estimates that the stimulus package could be announced as soon as October, potentially at the next Standing Committee of the National People’s Conference at the end of the month. The package could amount to as much as 3 trillion yuan, or $427 billion, and include an “open-ended commitment” for a bigger stimulus package the following year. There is no point doing things in half measures now.

SocGen believes those measures “could push GDP growth to 5% next year, up from the bank’s original estimates of 4.5% growth. The undervaluation of China equities is something that we observe across different benchmark indices and sectors. Most markets are trading well below or within their 10-year history. We expect the policy shift to boost corporate earnings growth to as much as 15%. The exact magnitude of the boost will be subject to the size and details of the fiscal package … the sustainability of housing stabilization and household wealth recovery.”

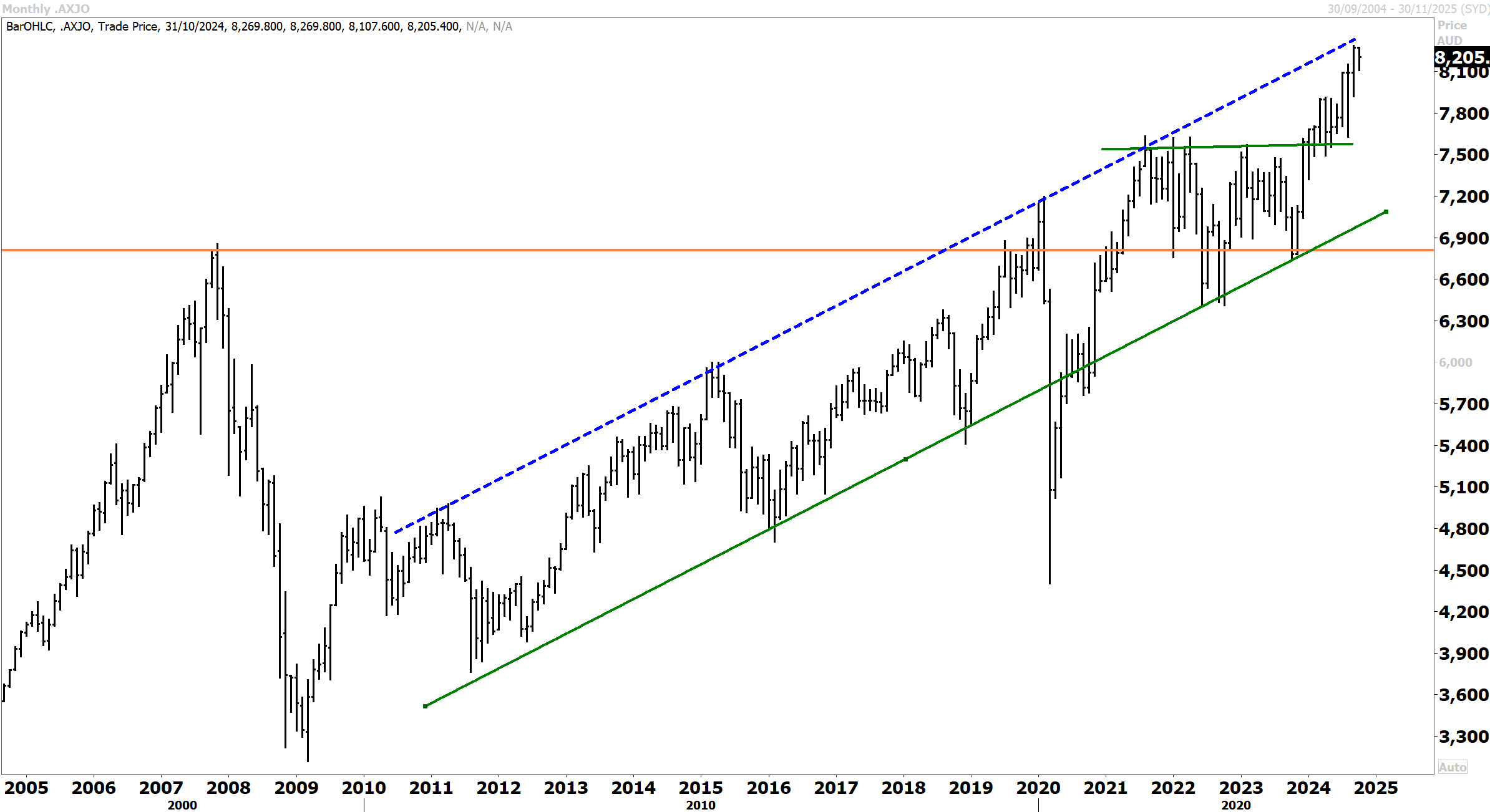

Turning to Australia, what’s good for China’s economy is good for Australia. Australian equities are in a new bull market and I believe that the ASX200 could surge towards 9000 by the end of next year especially if China follows through on fiscal stimulus and the RBA commences easing (where my base case is for the new cycle to commence by the end of December).

Last week UBS upgraded their target on the ASX200 to 8,500 by June next year. UBS strategist Richard Schellbach has put a bullish price target on his call for an ASX “melt-up in the coming months” and expects earnings upgrades and the emerging rate cut cycle to help fuel the ASX to 8500 points by mid-2025.

Mr Schellback said that “back in May we warned that many fundamental analysts were likely to remain frustrated and confused, as a ‘mini market melt-up’ plays out through equities. Since this time the foundations behind this ‘melt-up’ scenario have only firmed, and with the outlook for macro and rates now having improved … we believe the sentiment and momentum behind this rally has only become more solid.”

I totally concur with this view and have been encouraged by the ASX200 climbing the proverbial worry wall over the course of this year despite tough economic headwinds. Retailer Solomon Lew said in his career he has not seen tougher conditions in 61 years. Despite all this, the ASX200 is continuously making new record highs.

The stock market is not the economy. The ASX200 is sensing where the Australian economy will be next year, and on this front I believe growth will soon reassert due to aggressive easing by the RBA and the new course being charted for Chinese economy. The resources sector in particular could surprise in the year ahead and play catch up to the banks.

On the big picture 20year chart below the ASX200 has risen consistently with a upward trend channel since the defining lows established during the Global Financial Crisis. This year the ASX200 has risen to touch the upper boundary at the top end of the range. Resistance near term could intensify above 8200 and there could be some volatility ahead in coming weeks and a correction, but this would open a buying opportunity. I continue to see a strong finish for the ASX200 into the end of the year and new record highs.

Carpe Diem!

Angus

Disclosure: Fat Prophets and its affiliates, officers, directors, and employees may hold an interest in the securities or other financial products relating to any company or issuer discussed in this report. Fat Prophet’s disclosure of interest related to Investment Recommendations can be provided upon request to members@fatprophets.com.au.

Chart Source: Thomson Reuters