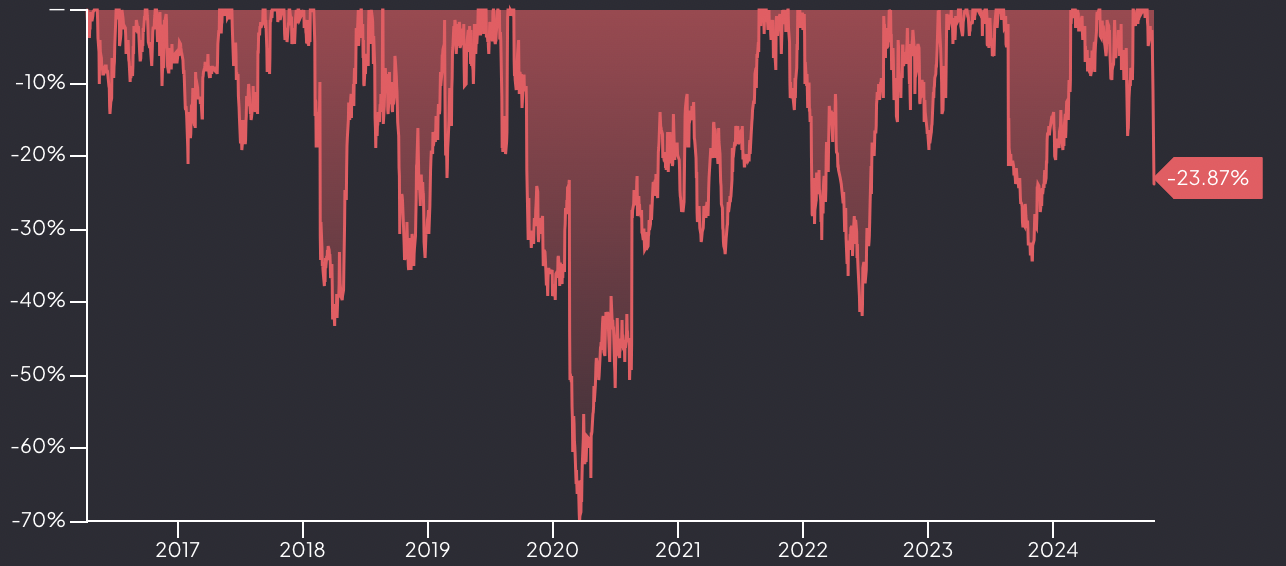

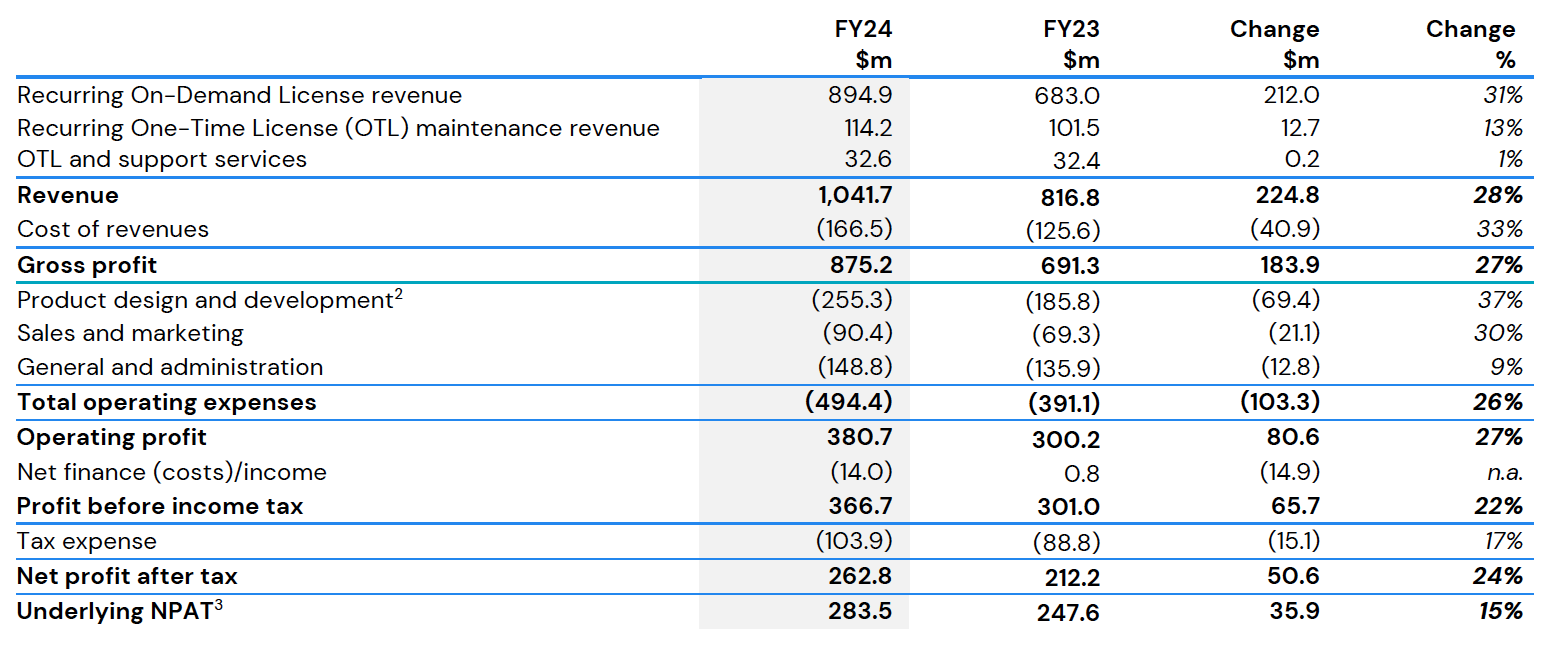

WiseTech Global shares tumbled -14.6% in Monday trading marking the biggest daily drop in over a year, extending a weekly drop to over 21%. This followed media reports circling billionaire co-founder and CEO Richard White. Has the drama created a buying opportunity? We consider the case and believe so, recommending members consider taking advantage of the share price weakness in this high-quality business. We rate WiseTech Global as a new buy. In our last technical update, we noted that “WiseTech Global remains in a consistent uptrend and has reached a new record high. With the valuation high, any volatility in US tech stocks over the coming months could deliver a better buying opportunity in WTC. Support now looks solid at the $90 breakout level.” Following the big reversal yesterday, WiseTech quickly found support at the $100 breakout level of several months – which opens a potential buying opportunity. Provided the shares hold above the breakout level at $100 (which is the base case technical view) the primary uptrend should remain intact, with topside momentum to resume in the coming months. Background The media reports claim White paid a former sexual partner to settle accusations made in 2020. The media reports do not assert the allegations are true but note their existence. Additionally, the reports raised attention about governance after it was revealed that WTC paid a former female executive $2.7 million in 2019, more than double White’s salary at the time, without disclosing the hefty remuneration package to shareholders. None of the reports suggested the executive received favourable treatment, just that the board had raised the issue with Mr White. Mr White was quoted as saying over the weekend that his relationship with the female executive “have always only been business-related.” The executive left the company in late 2020. These reports follow several others in recent weeks about White’s past relationships and behaviour with women. Although they seem largely private, the reports have spotlighted White’s leadership and the board’s governance. The company responded in a Monday filing with the ASX, saying “The Board of WiseTech Global (WiseTech, the Company, ASX: WTC) notes further media coverage today regarding Chief Executive Officer & Executive Director, Richard White, including an historical claim. The Board is currently reviewing the full range of matters raised in today’s media reports and is actively seeking further information and taking external advice. The Board will continue to meet regularly to consider and monitor the situation, and keep the market updated in line with its continuous disclosure obligations. It is conscious of the potential impacts on the Company and will carefully evaluate all relevant factors in its assessment.” A further report this morning in The Australian Financial Review said, “Billionaire businessman Richard White has been selling hundreds of millions of dollars worth of shares in the software giant he founded to pay his ex-wife, contradicting earlier explanations for the sell-off.” Last week, Mr White disclosed selling more than 350,000 shares worth approximately $46 million, taking October sales to over $100 million. We note that Mr White has been regularly selling shares in recent years, which isn’t unusual given his large holding of about 1/3 of the business and the regular share sales are well-known, as noted in the media, including by the AFR. The AFR article noted,” There is no suggestion that the sales this month were triggered by the investigation published by the Financial Review, the Herald and The Age.” The reports have reportedly captured the attention of major shareholders and institutional advisers. The AFR cited Institutional Shareholder Services’ Vas Kolesnikoff as saying, “Private matters are private; company matters are not, and the disclosure issues by the company surrounding its executives is obviously something we will be looking at.” He added, “The board needs to tread carefully here – if it did not disclose company matters relevant to shareholders, then it needs to explain; the board needs to be acting in the interests of shareholders here.” Where private and public intersect – an investment opportunity or not? The swirling media reports involve Mr White’s personal life, which should be just that, private. However, the potential overflow onto the business saw a material sell-off on Monday, adding to recent weakness. This is primarily because Mr White is seen as the visionary and driving force behind WiseTech’s impressive ascent into a global powerhouse that has created software solutions that simplify the incredibly complex world of supply chain management. The company has been a bold disruptor and has delivered stellar returns since listing in 2016. This has led to a lofty, albeit well-deserved valuation. These stocks tend to be more prone to dramatic drawdowns during market turbulence and/or changes in sentiment. WTC shares are no stranger to this, as shown in the chart below, highlighting the many substantial drawdowns since listing. The current drawdown is middling by comparison. The largest by far was amid the pandemic when uncertainty abounded and supply chains were thrown into disarray. Will Monday’s move be the full extent of this drawdown? Only time will tell, but we believe this offers an attractive point to initiate a position, with the scope to chip in some more funds should this not prove the bottom, and the stock fall a bit further. This will likely depend on whether there are any more shoes to drop in the story. A buy the dip strategy has been lucrative for investors previously, although that is no guarantee here, as in any investment. Despite the recent correction, WTC shares have delivered impressive returns YTD. They had surged following an impressive set of FY24 results this past reporting season and an upbeat forecast for FY25. The results clearly displayed the scalability of WiseTech’s cloud-based, software-as-a-service (SaaS) model offers tremendous scalability. The company can expand its customer base without significantly increasing operational costs, leading to healthy (and growing) margins. In FY2024, WiseTech reported EBITDA margins of 48% and achieved its goal of hitting a 50% margin run rate in the fourth quarter (a year ahead of schedule). This scalable model and recurring revenue from long-term contracts provide high visibility into future cash flows and earnings. Revenue grew by 28% to $1.04 billion, with organic growth at 15%. This was driven by CargoWise revenues increasing by 33% reported and by 19% organically. Recurring revenue accounted for 97% of group revenue (and 98% of Cargowise), up one percentage point. With a compound annual growth rate (CAGR) of 33% over the last eight years for CargoWise, WiseTech has demonstrated consistent growth. Gross profit increased 26% to $889.1 million, as the gross profit margin dipped slightly from 86% to 85%, a l byproduct of integrating acquisitions. The company’s ability to maintain such high margins while absorbing the costs of new acquisitions speaks to its operational efficiency and scale advantages. EBITDA surged 28% to $495.6 million, reflecting an EBITDA margin of 40bps from FY23. As noted above, in the fourth quarter, WiseTech hit a 50% EBITDA margin, a milestone reached a full year ahead of schedule. Statutory NPAT increased by 24% to $262.8 million. On an underlying basis, net profit after tax was $283.5 million, up 15%. Source: WiseTech Global Basic earnings per share came in at 79.4 cents, an increase of 23% from the previous year, while underlying EPS was 85.7 cents, up a more modest 15%. The company also declared a final dividend of 9.2 cents per share, representing a 10% increase from FY23. Free cash flow increased by 14% to $333 million even as the FCF conversion rate declined. Guidance was upbeat, which is a key reason why Wisetech shares spiked after reporting FY24 numbers during reporting season. WTC guided for FY25 revenue of $1.3-1.35 billion and EBITDA of $660–$700 million. The company is targeting an EBITDA margin of 51-52%. The Secret Sauce For those unfamiliar with the business, At its core, WiseTech is a technology company that builds software to help logistics companies manage their complex operations and does it superbly. The flagship product, CargoWise, is like the control centre for freight forwarders, customs brokers, and logistics providers. Over 17,000 customers use it in more than 180 countries, including some of the largest logistics firms in the world, such as DHL. Although Wisetech continues to develop new products, CargoWise remains its secret sauce. In FY24, CargoWise generated $880.3 million in revenue, up 33% reported and by 19% organically. Non-CargoWise revenue reached $161.4 million, up a modest 3% reported. CargoWise does a wide variety of tasks a logistics company needs on a single platform. It’s like a Swiss all-in-one tool that tracks shipments, handlies customs paperwork, books transport, manages warehouses, and even ensures compliance with regulations in multiple countries. Instead of juggling a dozen different software systems, companies can do it all with CargoWise, saving time, money, and headaches. This makes CargoWise an easy-selling proposition, and customers rarely switch. The software is cloud-based, meaning it’s accessible from anywhere in the world. It’s also packed with automation tools, which allow logistics companies to reduce manual work, improve accuracy, and speed up their processes. WiseTech is known for growing its empire through acquisitions. Over the past decade, it has acquired more than 40 companies, helping it expand into new regions and adding more capabilities to its software. These acquisitions allow CargoWise to cover the full spectrum of logistics needs. WiseTech serves various logistics companies, from small local businesses to giants like global 3PLs (third-party logistics providers), freight forwarders, and e-commerce players. Wisetech states that the top 25 global freight forwarders use its software, and 46 of the top 50 global 3PLs. CargoWise is particularly popular with large global freight forwarders (LGFFs). These companies operate in multiple countries and need a system that can handle international logistics, compliance with local laws, and various customs regulations. CargoWise offers the functionality to track shipments across different borders and comply with different rules—all from one platform. A Sticky Business is a Good Business One of WiseTech’s most powerful business aspects is that customers rarely leave the building. Once a company starts using CargoWise, it becomes deeply embedded in its operations, leading to high switching costs. And why bother when CargoWise delivers a huge return on investment for users? Wisetech benefits from a growing river of recurring revenue with low customer churn. CargoWise’s customer retention rate has been over 99% for the last 12 years. Wisetech wants its software to become the operating system (like Microsoft 365) for global logistics and is well on its way. The company has already integrated over 5,600 product enhancements in the last five years, continuously improving its software to meet the needs of a rapidly changing world. For even the largest LGFFs and 3PLs, the expense of developing a competing system with an equivalent capability usually isn’t worth it. Over the past five years, WiseTech has invested more than $1.1 billion into product development. WiseTech’s commitment to product innovation—demonstrated by CargoWise Next and ComplianceWise—continues to differentiate it from competitors, with launches scheduled for 1H25. Summary There is a risk that more shoes will drop from these reports, which could prompt leadership changes. A scenario where Mr White’s responsibilities at the business change would likely see a more substantial drawdown unfold. One must also consider his large shareholding. We currently view the scenario of major leadership changes as unlikely. Our base case is for a strengthening of governance issues. Another risk is the growing capability of AI in industry verticals such as the logistics industry, which could see more companies pursue their own AI-built solutions, adversely impacting WiseTech’s sales. It is still early days here and despite the odd outlier (like Klarna in FinTech), we don’t see massive change or risk here yet. There are other risks, but on balance, nothing that deters us from taking advantage of the recent weakness in WiseTech shares. Ultimately, WiseTech Global has built an exceptional product in CargoWise, a logistics software deeply embedded in the operations of many of the world’s largest freight forwarders. The impressive business model has substantial recurring revenue, low customer churn, and expanding margins, making it a growth investor’s dream. In our prior coverage, we noted how the valuation left little room for error. This recent weakness has provided some wiggle room and an opportunity. We see a long runway of impressive growth ahead. We recommend WiseTech (ASX: WTC) as a new buy. Disclosure: Interests associated with Fat Prophets hold shares in WiseTech Global.

WiseTech Global shares tumbled -14.6% in Monday trading marking the biggest daily drop in over a year, extending a weekly drop to over 21%. This followed media reports circling billionaire co-founder and CEO Richard White. Has the drama created a buying opportunity? We consider the case and believe so, recommending members consider taking advantage of the share price weakness in this high-quality business. We rate WiseTech Global as