The ASX200 kicked off the week with a modest +0.2% advance on Monday, although this masked some sharper fluctuations at the individual company level. Gold stocks extended their rally, tracking elevated gold prices. Most sectors gained, and in the broader ASX300, advancers outnumbered decliners by a ratio of about 1.6 to 1. There were no major local economic releases. SPI futures are pointing to a 0.46% gain on the open.

Nine ASX sectors gained, led by tech +1.2%, utilities +0.8% and industrials +0.7%, while energy -1.2% and consumer staples -1% were the only sectors to post declines. Technology stocks mirrored gains from American peers and were helped by a +16.8% surge from Life360 following an upbeat market update showing some 4.8 million active users added over the past quarter. Origin Energy +1.8% and Meridian Energy +3.2% lifted the utilities sector. Qantas Airways stood out in the industrial sector, as the Flying Kangaroo announced substantial changes to the loyalty scheme.

The materials sector added +0.4%, as Fortescue +0.3% and Rio Tinto +1% benefited from higher iron ore prices in Singapore trading, although BHP -0.2% lagged. Several brokers have been lifting estimates for Rio Tinto as the mining giant diversifies from iron ore.

The more interesting action was in the gold sub-index, which rallied +2.7%, with support from Northern Star +2%, Newmont +6.6%, De Grey Mining +4.3%, Genesis Minerals +4.9%, and Gold Road Resources +2.7%, among many others. Silver Lake Resources gained +3.5%, attaining 12-month highs on robust 3Q gold sales and upbeat guidance.

Silver Lake has broken out above near-term resistance which likely confirms an inflection. Confidence would be raised once the primary downtrend resistance is cleared at $1.60/$1.80, but the technical setup now retains a bullish disposition.

At the smaller end of town, St Barbara surged +14.6% thanks to Simberi gold production increasing 33% to 17.257 ounces in the March quarter. The company had a total cash balance of $218 million at the end of the quarter and no debt, firmly underpinning the valuation given the market cap is below the cash backing.

St Barbara Mines has traced out a significant bottom between 2022 and 2024 with the recent topside breakout above resistance likely confirming an important inflection. Scope is now raised for a potential decent recovery back towards the next major resistance level at 70 cents.

Westpac has turned more bullish on copper, lifting their copper price forecast upward to US$9,000 per ton by year-end and US$9,700 for 2025 in response to tightening supply and robust demand. This follows downgraded production forecasts for 2024 and difficulties in bringing new projects online. Sandfire Resources gained +2.4%, while 29Metals declined -2%.

The heavyweight financial sector added just +0.1% as muted advances for the big four banks were partially offset by a -1.0% decline from Macquarie and a -0.5% slip for QBE.

The energy sector dropped -1.2% as oil prices gave back some recent gains. In addition, Beach Energy tumbled by 15% as the Waitsia project in WA saw cost blowouts. Index large-caps Woodside -1.6% and Santos -1% slipped. Coal miners Whitehaven +0.4% and New Hope Corp +1.3% logged modest advances.

There was some divergence in the uranium space, with Paladin Energy surging +6.7% as Morgan Stanley initiated at overweight with a $1.75 price target. However, the bank’s equal weight call on Boss Energy saw the latter dip -1.2%. Paladin recently announced uranium concentrate production, and drumming was achieved at the Langer Heinrich Mine in Namibia on 30 March 2024. The company’s focus will now shift to ramping up production and building inventory before shipping to customers. Paladin is well-placed to lean into the favourable demand and supply dynamics for the uranium market over the medium and long term.

Paladin Energy has broken out above key historic resistance at $1.50 which if sustained will raise the scope for a broad-based recovery to the next major support levels at $2 and $3 over coming years.

Meanwhile, Elders endured a -24.4% slump after saying 1H24 performance was significantly below expectations, as weather, farmgate prices, and margin pressures for agri-chemicals hurt trading. Elders guided for underlying EBIT of $120 to $140 million for FY24, well below last year’s $171 million. This interrupted a solid recovery from the stock’s subdued levels plumbed in late 2023.

Elders’ topside inflection was interrupted yesterday, but despite the magnitude of the fall, looks to be checked by support at the $7.20/$7.40 level. If this support level can hold, the technical setup still retains a bullish disposition. If Elders breaks below near-term support at $7, then a retest of the $5.50 low cannot be ruled out.

Elsewhere, Ansell was in a trading halt and is raising $400 million (an SPP will follow) from institutions to buy Kimberly-Clark’s personal PPE business in a deal worth up to US$640 million. Domino’s Pizza +3.05% and HUB24 +2.8% had a solid day, while Paradigm Biopharmaceuticals -6.1% and Nufarm -3.6% were deep in the red.

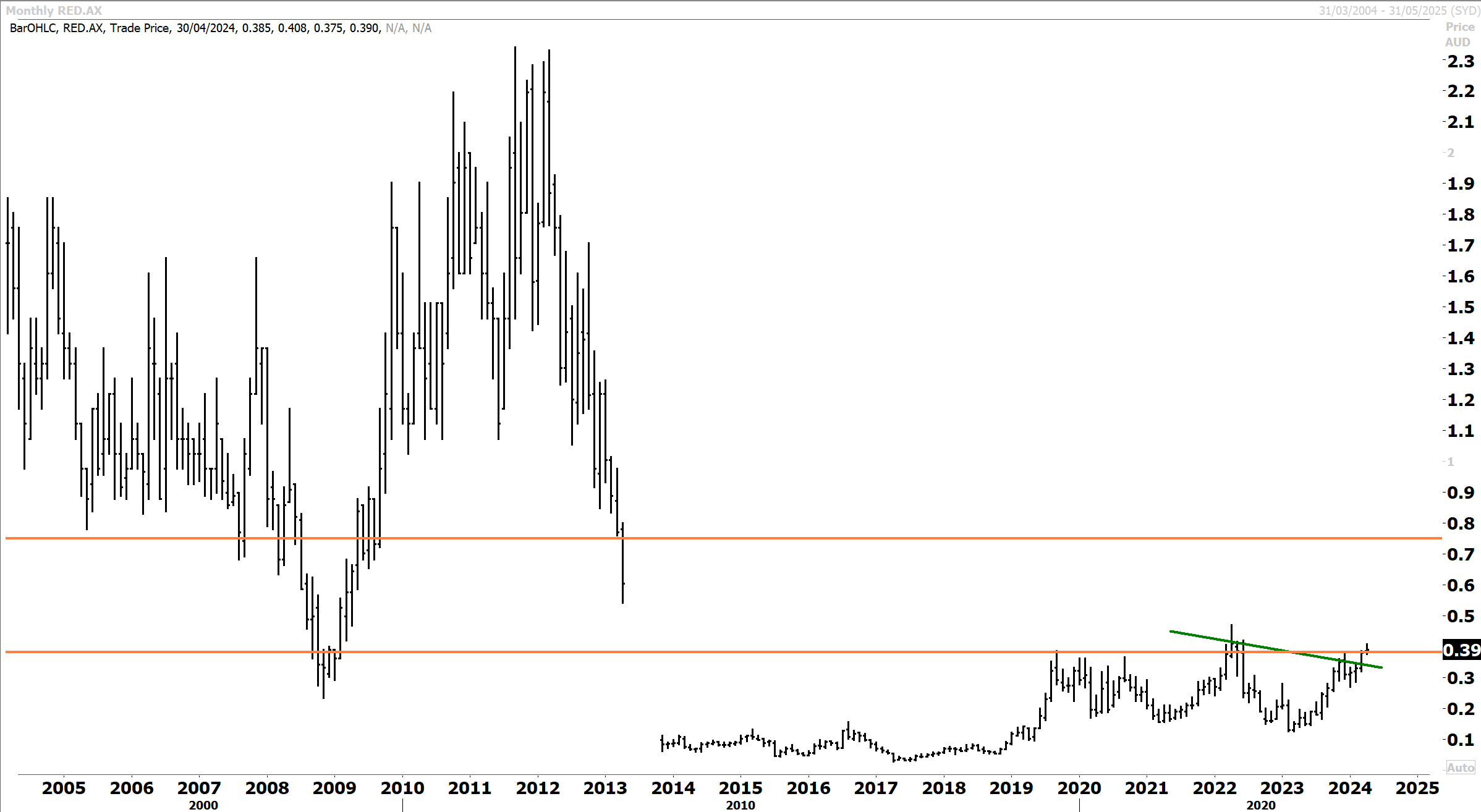

Red 5 advanced +1.3% on the back of a successful March quarter with the King of the Hills (KOTH) gold project in Western Australia, achieving production of 50,132oz, marking the fourth consecutive quarter of exceeding 50koz. Despite production being affected by a maintenance and a planned shutdown in February/March, overall mine performance remained strong for the quarter. Red 5 anticipates higher production in the June quarter, with no major shutdowns planned for the remainder of the financial year.

Red 5 is in the process of clearing topside resistance at 40 cents which has effectively capped the stock since 2019. Once the 40-cent level is convincingly cleared on the topside, Red5 could potentially ‘close the gap’ and recovery to the next major resistance level between 70c and 80c in the coming year.

Carpe Diem!

Angus

Disclosure: Fat Prophets and its affiliates, officers, directors, and employees may hold an interest in the securities or other financial products relating to any company or issuer discussed in this report. Fat Prophet’s disclosure of interest related to Investment Recommendations can be provided upon request to members@fatprophets.com.au.