Key themes and stocks discussed today:

- Wall Street benchmarks closed marginally in the red but held up well in the face of rising bond yields, with the 2yr hitting 5%. Jerome Powell predictably dialled back on the rate cut narrative, citing inflationary pressures. Stocks anticipated the pivot well in advance. Reporting season continues to ramp up with mixed results and reactions.

- Gold rose amidst stronger and higher bond yields, further evidence of the historical inverse correlation breaking down. JP Morgan and Citibank upgraded their outlooks for the spot gold price. Citi has the most aggressive price target, saying gold can smash through $3000oz, driven by ETF, central bank buying, and rising geopolitical tensions.

- Morgan Stanley’s Mike Wilson discussed the rising bond yield landscape and where to be defensive in the market – overweight energy, cyclicals, and materials.

- Housing data turned down sharply in March, as elevated interest rates and uncertainty about when a dovish pivot will appear dampened demand.

- The ASX 200 tumbled on Tuesday following a soft lead from Wall Street. Losses were broad-based, with only modest buy-the-dip trading in the late afternoon. The technical setup for the ASX200 continues to screen bullish, with an uplift for the index this year potentially coming from the under-owned banks and resources sector.

- China’s ‘data dump’ was a mixed bag. GDP handily topped expectations, but several other data points cast concern on an uneven economic recovery. Greater China shares fell. The Hang Seng lost 2%, but the technical set-up still favours a breakout from the primary downtrend and exit from a bear market this year.

- Japanese stocks slumped as rising bond yields and general risk aversion led to broad-based selling. The yen’s woes continued.

- Declines were broad-based across UK and European markets due to the combination of inflationary concerns and heightened Middle East tensions.

- Notable charts and stocks mentioned today include the US2yr bond yield, Russell 2000, Gold – 20yr and 5yr charts, Bloomberg Commodity Index, SPDR Materials ETF, S&P500, Platinum, Hang Seng, FTSE100, ASX200, Morgan Stanley, Bank of America, J&J, UnitedHealth, Tesla, Barrick Gold, Antofagasta, Powerhouse Energy, LVMH, PetroChina, Alibaba, Sony, Global X Physical Gold ETF, Antofagasta, HUB24, Sandfire Resources, Suncorp, Zip Co and Macmahon.

Good morning,

Despite closing marginally in the red, Wall Street benchmarks held up relatively well after the US 2yr bond yield hit 5%. Federal Reserve Chair Jerome Powell pushed back on the mid-year rate cut narrative and said recent inflation data had not given policymakers enough confidence to ease credit soon. He also mentioned the Fed might need to keep rates higher for longer than previously thought. The US dollar index notably didn’t follow closely, with the 10yr higher ending up just 0.1% on the day at 106.3. Gold’s inverse correlation is also breaking down, with spot prices surging 1% to $2405oz. Israel did not rule out a counter-strike on Iran.

The S&P 500 lost 0.21% to end at 5,051, the Nasdaq Composite lost 0.12%, and the Dow Jones rose 0.17%. The Russell 2000 was lower by 0.4%, while the VIX was down 4% to 18.4. The S&P 500 and the Nasdaq are nearly 4% off from last month’s record levels. The technology and healthcare sectors were the biggest support for the S&P 500, while real estate was the biggest drag as yields rose across the curve.

The market narrative seems to have shifted towards strong US economic growth (as evidenced by Monday’s strong retail sales), cancelling out inflationary pressures and rising interest rates. Small/midcaps that are more sensitive to rates notably underperformed for a third trading session. Morgan Stanley added 2.5% after beating estimates, while Bank of America and Johnson & Johnson fell after missing. The reporting season cranks up this week and next with a slew of companies set to report. China’s GDP growth data surprised yesterday on the upside, coming in at 5.3%. However, this was cancelled out by the stronger greenback, which weighed on emerging markets.

Bond yields rose across the curve. The US 2yr rose 6 bps to 4.98%, while the US 10yr added 7 bps to 4.67%. The ’22 highs at 5% are now within just 33 bps. Supply is an ongoing issue with US fiscal spending unlikely to be reined in anytime soon. Commodities were generally softer, although WTI and Brent crude were steady, and Comex gold added 1% to $2404. Silver succumbed to profit taking, losing 2.4% to $28.17. Copper was off by 1.8% to $4.30 after touching nearly $4.40 yesterday.

Jerome Powell’s remarks represent a shift in his message following a 3rd straight month where inflation exceeded analyst forecasts and pointed to little urgency to cut rates. “If price pressures persist, the Fed can keep rates steady for as long as needed. The recent data have clearly not given us greater confidence and instead indicate that is likely to take longer than expected to achieve that confidence. Given the strength of the labour market and progress on inflation so far, it is appropriate to allow restrictive policy further time to work and let the data and the evolving outlook guide us.” My base case is that the Fed’s rate cuts will be on hold until at least September, and there is even doubt over whether easing commences then with inflationary pressures on the ascent.

The technical setup for the US 2yr following the recent breakout from a contracting triangle range points to a retest of the ’23 highs in coming months. A breakout in rates above this ceiling, would likely drag the US10yr back up to 5%.

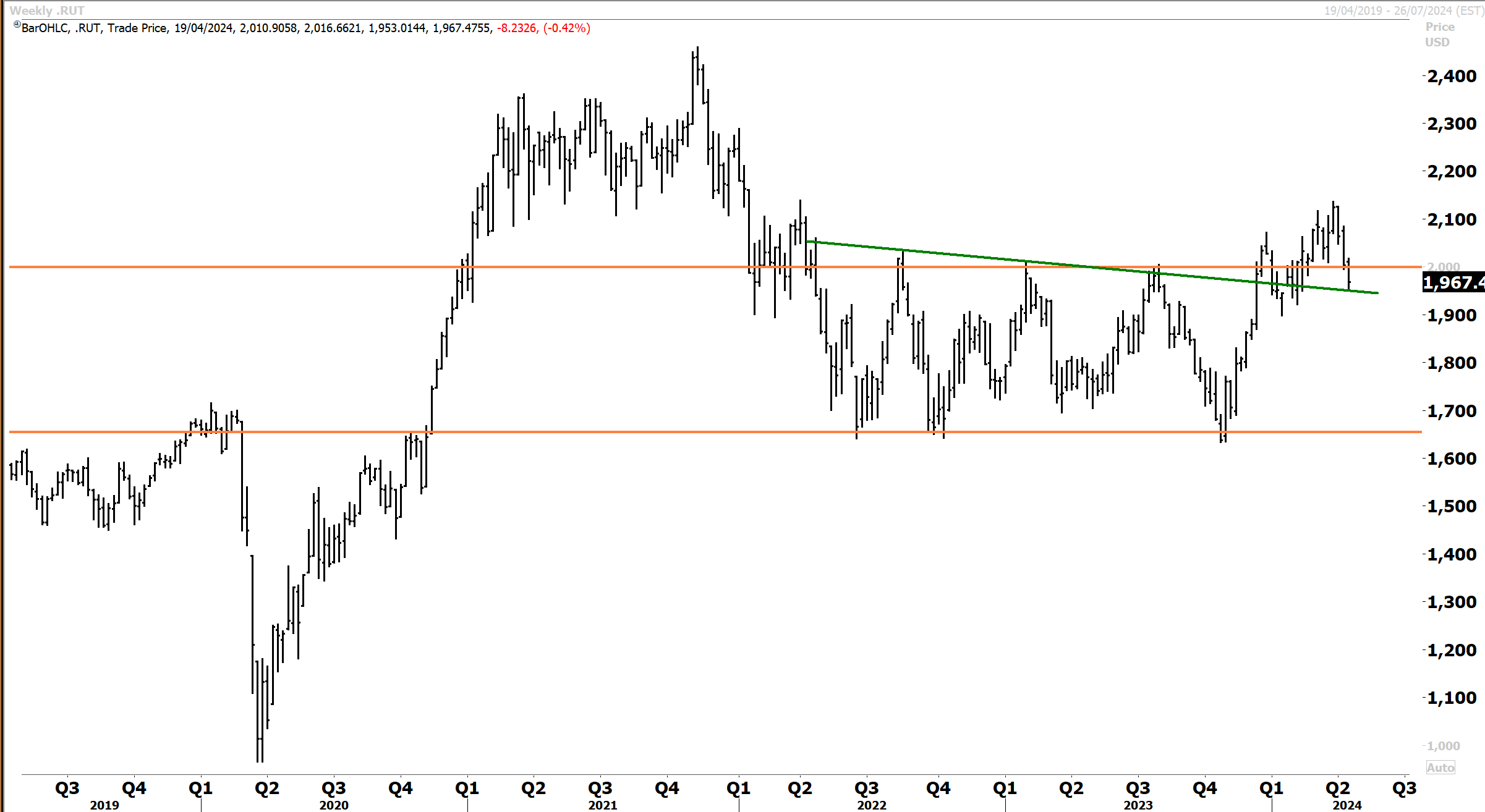

Stocks largely shrugged off the selling in the bond market on Tuesday, but there is a question mark over just how long equities can remain agnostic. The Russell 2000 has failed to sustain the breakout of the 2022/23 range and is at risk of extending lower over the coming months, particularly as bond yields rise. An upward dynamic back above 2000 is needed to keep the prior bullish technical outlook intact.

Morgan Stanley’s Mike Wilson summed up the move in the bond market on Monday, noting that “stickier than expected CPI data last week led the bond market to price out nearly another rate cut for this year and push back on the start of the cutting cycle. Importantly for stocks, the 10-year US Treasury yield broke out above the 4.35-4.40% level that we identified as a meaningful threshold for equity valuations, and rate/equity correlations fell further into negative territory. Small caps and lower quality areas of the market underperformed given their greater sensitivity to a rise in rates and more levered balance sheets. We maintain our large cap quality bias across both cyclicals (energy and materials) and growth.”

Despite Tuesday’s correction in the materials, energy, and precious metal sectors, the technical setup continues to look bullish. The SPDR Materials ETF has corrected following the recent breakout, but support looks robust below $88. The incumbent correction (which is also underway in the SPDR energy ETF) should soon find support and reassert itself on the topside.

Mike asked the question “what do higher rates mean for valuation?…While the level of rates suggests valuation is rich, the statistical relationship between the rate of change on rates and equity multiples implies that today’s market multiple is fairly valued. That said, this regression suggests that further upside in yields from here would be a headwind for valuation. This fits with our view that rate sensitivity for large caps would likely only become significant on a decisive break higher above 4.35-4.40% on the 10-year. Under the surface, valuation dispersion is on the rise as the market becomes more discerning around quality and earnings achievability. Stock reactions during earnings season will likely provide an indication as to how much risk there is to valuations”.

The reporting season has so far been a mixed bag. Many companies are going to report this week which will allow investors to join the dots and conclude whether the ostensibly strong economy will flow through to corporate earnings. Some companies will be dealing with higher bond rates very well, but those with large debt profiles will not due to higher rate sensitivity. Mag 7 and AI names are due to report next week, and here the market will be watching closely with valuations now stretched.

JP Morgan cited this risk yesterday with Marko Kolanovic highlighting that “equities remain significantly higher YTD and continue to hover around all-time highs, while credit spreads are trading at or near post-GFC tights. The equity move, driven mostly by multiple re-rating, is disconnected from the significant increase in bond yields and repricing of the Fed following a streak of hot inflation prints. Persisting inflation forces raise the risk that rates will need to stay higher for longer than expected, which could in turn weigh on economic activity and equity valuations. For a market reliant on immaculate disinflation, a dovish Fed reaction function, and diminishing tail risks on growth, the continuation of hot growth and inflation data can bring us to a tipping point where a tighter stock vs bond risk premium finally produces a market correction.”

US equities are ripe for a corrective selloff, and my base case is for a retest of the 4800 and possibly the 4600 levels in the coming months. Other stock markets should follow suit, with possibly the CSI300 and Hang Seng indices proving to be the exception having endured a deep bear market in recent years. I also expect the energy, materials, and precious metal sectors to outperform given rising underlying spot prices and the catch up of last year’s underperformance.

Marko cited “inflationary risks are also compounded by upside risks to oil due to geopolitical developments related to Russia and risk of further escalation in the Middle East. Additionally, investor positioning is elevated, with cash allocations at historical lows. We therefore maintain an overall defensive stance in our model portfolio, with an UW in equities and credit vs. an OW in commodities (as a hedge for inflation/geopolitics) and cash.”

Since the Bloomberg Commodity Index broke out above the primary downtrend earlier this month, an upside extension has ensued. Given that global investors remain significantly underweight the asset class, corrective pullbacks are likely to be generally bought.

On gold and base metals, JP Morgan revised their metal price forecasts for 24/25 by lifting price targets. For gold, copper and aluminium, JPM sees spot prices gaining +11% to $2555oz, 9% to $11,050ton and 9% to $2,738 ton, respectively. JPM cited that “amid resurgent Mining sector outperformance in the last one month, our analysis reinforces our conviction that Diversified Miners represent significantly cheaper and undervalued exposure to metals price momentum”. On platinum, JPM highlighted “our continued bullish stance on gold and $2,600/oz looms into sight – with the platinum / gold ratio standing at a record low we believe platinum has potential to rally higher due to its precious metal credentials”.

While platinum and palladium are yet to confirm topside breakouts, the technical case is building to follow silver and gold higher. Platinum is converging within a contracting range and testing the primary downtrend in place since the highs above $1300oz set back in 2021. Similar to silver, the technical outlook is bullish with my base case for a topside breakout to occur sometime next quarter.

On energy and precious metals, JPM noted that “one part of our asset allocation that has done well is our OW in commodities, especially Gold and Oil. We have highlighted in the past the outperformance of gold of around ~10% in earlier rate cutting cycles, so we consider whether this trade is still well-supported in an environment where rate cuts may be disappearing. Despite real rates being the single best factor for gold prices, this has not worked at all in the recent period, with gold ~$380 above where real rates would suggest. While still bullish, this argues for caution as there are other factors that have become incrementally more important.”

The fact that gold has held up amidst an upward surge in the US dollar contrasts with typical precedent over the past several decades. Deep buying from the central banks is breaking the historical correlation and is likely to provide strong support and mitigate against any future correction. Since breaking out above the historical resistance at $2000 gold has added 20%. Near term corrective risks remain, however, I would expect any selloff to be relatively shallow.

Additionally, JPM noted that “China accounted for 22% of the buying in 2023. In relation to the recent rally, ~15% up since March, the incremental buying that started two years ago does not explain this, since if anything, we would expect reserve manager buying to slow in the face of rising gold prices, although we’ve been pleasantly surprised to see less physical selling despite the higher prices. So, we view the reserve manager buying as a longer-term phenomenon and attribute the recent rally to momentum traders and CTAs…Technical levels are not an imminent threat. Meanwhile gold buying via ETFs has been anaemic although this can improve as rate cuts reduce the benefit of parking money in cash, making gold relatively more attractive. For both reserve managers and retail in China and elsewhere, we see a sound case for gold as asset diversification, acting as a hedge for both inflation and geopolitics”.

During the last big cycle for gold back in 2006/2012, the spot price ran on the upside for nearly five years after breaking out above the key psychological $1000 level. There were corrective pullbacks along the way, but these were relatively shallow as gold climbed nearly 100% to touch levels above $1900oz. A similar dynamic looks to be underway following the recent big breakout. A correction could ensue at any point, but investors should use this to accumulate, with the technical setup favouring an upside extension towards $3000.

I should also highlight that the 2006/2012 cycle was accompanied by the GFC when the Fed and US government launched quantitative easing measures. At the time, most analysts and strategists saw this as inflationary, which it initially was. However, by 2012, QE was being withdrawn, and inflation came back under control. The US fiscal situation was vastly different, however, with much lower debt levels and lower interest costs of servicing that debt. Interest rates remained low for many years after the QE experiment was first launched.

This “time might be different”, particularly given the recent upward move in commodity prices. The first phase, which induced a lot of inflation, immediately followed the Ukraine war. Inflation is now proving sticky and commodity prices are on the ascent. My base case is that a second phase is now underway and that despite elevated bond yields, the dollar could soon turn downwards as the fiscal position of the US continues to deteriorate.

Citibank this week joined MS, Goldman Sachs and JP Morgan in raising their price target for gold, which they believe will surge another 25% as the bullion’s appeal rises amid growing tensions in the Middle East and looser monetary policy on the horizon. Citi strategists said the momentum is still rolling and that gold could “smash through $3,000 per ounce within the next six to 18 months, a 25% leap from current levels.” Citi upgraded its 2024 price target for gold to $2,350 and adjusted the 2025 forecast to $2,875. They also expect trading to regularly “test and breach” $2,500 per ounce in the latter part of 2024.

“The recent gold rally has been aided by geopolitical heat and is coinciding with record equity index levels; so a steeper risk-off environment should further boost prices. Gold has also surged upward lately despite a rise in real and nominal yields, a more hawkish monetary policy, and a rallying US dollar. Even as the implied ‘duration’ of gold has shortened since June 2021, an eventual Fed cutting cycle and Treasury rally could be the bullish kicker to $3,000/oz.”

Citibank makes some good points that fit with my base case, although it is hard to call a ceiling when the US and other governments are all in the same boat with a deteriorating fiscal position. It is important to note that silver and gold precious metals are in bull markets with other PGMs and commodities likely to follow suit. It is early in this cycle. While corrections will ensue, investors should keep their nerve and stay committed to the broader underlying trend.

Citi concluded their bullish outlook by noting that “the Fed has indicated it will cut rates this year, which would further drive up the metal’s price, but March’s hotter than expected inflation has likely pushed the timing of cuts back to later in the year. “

Post-pandemic buying led by China and developed markets have also contributed to massive inflows into gold-backed exchange-traded funds. This will “buffer the path to $3,000.”

Turning to data, the market impact was muted as Jerome Powell’s comments held more sway. Industrial production increased 0.4% monthly in March, in line with expectations and matching the pace in February.

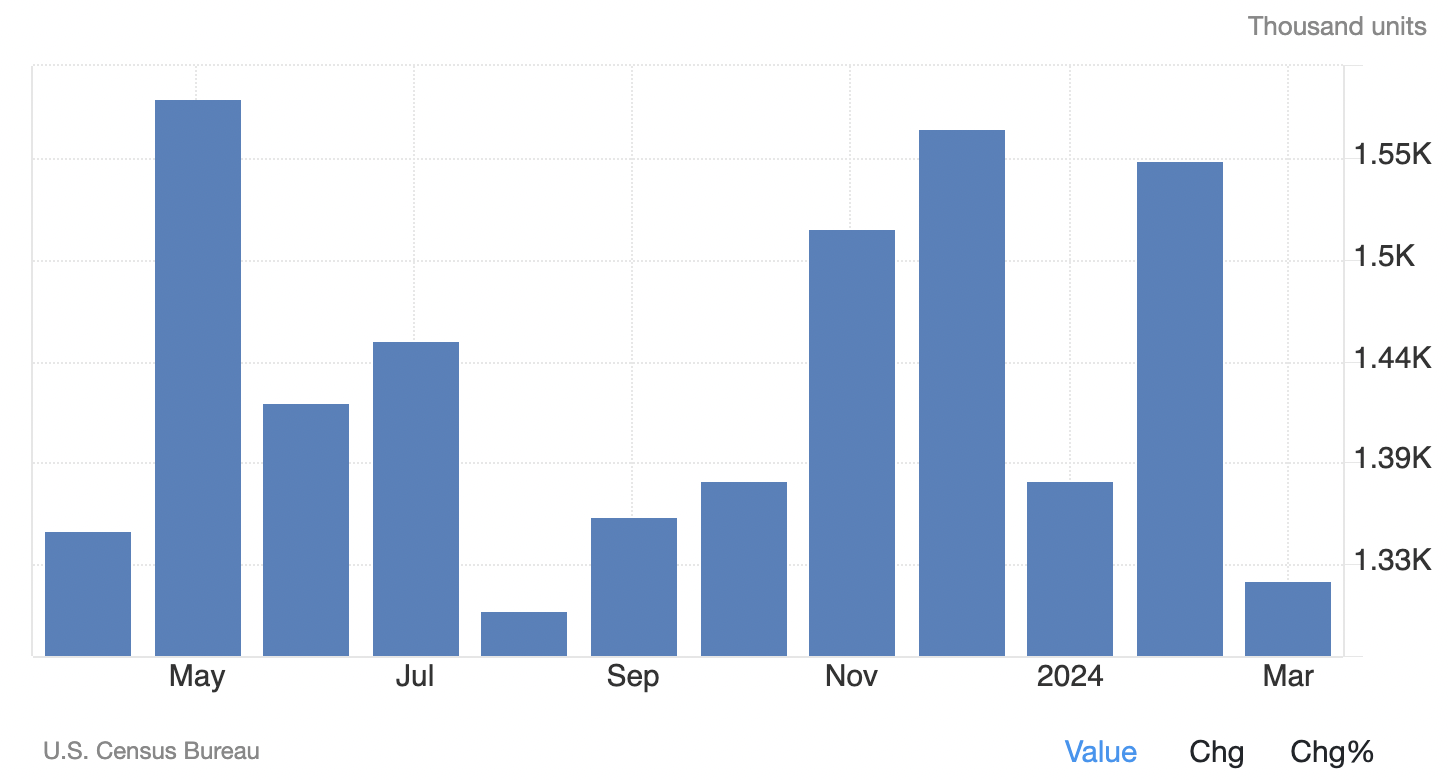

Housing starts tumbled 14.7% month-on-month to an annualised rate of 1.321 million in March, well below expectations of 1.48 million. That marked the lowest level since August and the sharpest fall since April 2020, as a rise in mortgage rates and growing uncertainty about when buyers will receive relief is clearly weighing on decision-making. Meanwhile, forward-looking building permits declined 4.3% to a seasonally adjusted annual rate of 1.458 million.

Housing starts – a steep slide…

Megacaps were mixed as bond yields rose. Nvidia and Microsoft posted modest advances, while Alphabet, Amazon and Meta were little changed. Apple slipped almost 2%, and Tesla declined another 3%, with the latest woe being a WSJ article that Cybertruck deliveries have been delayed.

Banking titans Morgan Stanley and Bank of America both topped market expectations but received very different market responses on Tuesday. Morgan Stanley gained about 2.5%, with the market beat driven by wealth management, trading, and investment banking (similarly to Goldman Sachs’ earlier figures). First-quarter earnings increased 14% to $3.41 billion, while overall revenue ticked 4% higher to $15.14 billion. While the beat was pronounced on the top and bottom lines, the $2.02 in EPS smashed the $1.66 analysts were modelling. Wealth management revenue was 5% higher at $6.88 billion, while the equities trading desk posted revenues up 4% to $2.84 billion. Investment banking stood out with a 16% jump in revenue to $1.45 billion.

Morgan Stanley remains in a corrective downtrend despite the profit beat on Tuesday.

Bank of America is closer to a traditional bank, although has sizeable wealth management, trading, and investment banking businesses. Revenue dipped 2% to $26 billion, although topped expectations. Profit fell 18% to $6.67 billion, hampered by a $700 million regulatory charge. Adjusted EPS of $0.83 exceeded the $0.76 consensus. Total deposits inched 1% higher to $1.95 trillion, while the loan book was flattish at $1.05 trillion. Net interest income of $14.2 billion was a slight positive surprise. The shares declined 3% as traders have pivoted to the banks with stronger investment banking franchises after the early results from earnings season.

On the 10-year chart below, Bank of America has long respected the primary uptrend and is holding above the breakout level, which potentially defines an inflection. An advance above $38 would mark the resumption of upward momentum.

On other major companies reporting, Johnson & Johnson slipped 2% despite a modest earning beat and in line revenue. Investors were slightly underwhelmed with the outlook. Health insurance giant UnitedHealth gained 5% after beats on the top and (adjusted) bottom lines. Revenue was up a solid 9% and a GAAP loss of $1.22 billion stemmed from cyberattack-related charges. Adjusted EPS of $6.91 was up from $6.26 a year earlier and exceeded the $6.61 consensus.

Gold prices rose, cresting $2,400oz, but precious metals exposures were mostly red at the close, including Coeur Mining, Hecla Mining, VanEck Junior Gold Miners ETF, and others. Barrick Gold fell 5% after missing quarterly production estimates. Bitcoin prices extended their pullback, weighing on the likes of Coinbase and Riot Platforms.

Australian equities tumbled in Tuesday’s session, following a weak lead from Wall Street. Upbeat US retail sales dampened anticipation for interest rate cuts from the Fed in the coming months, which flowed through in local money markets as well. The ASX 200 index slid by -1.81% as all sectors fell, although a modest rebound in late afternoon trading capped losses somewhat. In the broader ASX 300, only 16 stocks posted advances. A$ spot gold made a new high at A$3740oz, with the AUD touching 64c. SPI futures are pointing to a 0.3% decline today.

The ASX200 has corrected back to key support in recent weeks after touching a new record high above 7800. The technical setup for the ASX200 is bullish, in my view, with Australian equities in a new bull market. Commodities, materials, gold and energy prices are reasserting to the topside which should carry the substantial resources component of the market higher. Bank stocks have also turned a corner, which will provide an additional source of upward momentum for the index in the coming year. Domestic fund managers remain underweight in both key sectors. A break below the 7600 level would risk a deeper pullback but also open a buying opportunity.

While there were no significant economic releases on home shores, American retail sales and heightened tensions in the Middle East weighed on sentiment. There was a mixed data dump in China—see the Asia section for more details.

All eleven ASX sectors declined, led lower by consumer discretionary -2.4%, utilities -2.15% and materials -2%. The sectors falling the least were communication services -1% and consumer staples -1.2%. The ASX 200 has now endured a four-day slump, mainly mirroring the US market trajectory as bond yields have increased.

The consumer discretionary space is sensitive to rate expectations and sentiment about the broader economy. Wesfarmers, Aristocrat, and JB Hi-Fi fell more than -2%, while Harvey Norman slid -3.8%. The utilities sector is dominated by Origin Energy and APA Group, each of which fell by 1.9%.

In the materials sector, losses were broad-based, with BHP -1.8%, Fortescue -2.8%, and Rio Tinto -2.9% sliding despite iron ore prices being only marginally lower during Singapore trading. South32 took a -4.7% hit. The gold sub-index fell -1.5% despite elevated gold prices, although Northern Star -0.6% and Newmont -0.95% held up better than most of the mid-and small caps. Gold Road -6.2% extended declines from Monday, while St Barbara fell -7%. The Global X Physical Gold ETF (GOLD) bucked the trend, robustly adding +2.3%.

Since breaking above A$26, GOLD has extended higher to $34, opening a gap with A$ spot gold hitting a record high on Tuesday above A$3740. The ETF could potentially correct lower in the coming weeks, but support should be significant at the $29 level, which would open a potential buying opportunity.

Lithium stocks slumped, with Liontown Resources -6.4% and Arcadium Lithium -5% deep in the red. The news that Tesla is culling more than a tenth of the global workforce renewed concerns about EV demand in the short term. Copper miner Sandfire Resources impressed on Tuesday, adding +1.1% as most stocks were hammered. I’ve written much about the positive outlook for copper lately, and Sandfire is a significant copper ‘pure-play’ (more than 70% of revenue) in Australia. Smaller peer 29Metals didn’t escape the bloodbath, falling -7.1%.

The energy sector slipped -1.8% as oil and gas prices pulled back. Woodside -1.2% and Santos -1.5% endured modest declines, as did coal miners Whitehaven -1.4% and New Hope Corp -1.1%. Uranium players succumbed to the risk-off sentiment, with Paladin Energy -6.3%, Boss Energy -6.6% and Deep Yellow -8.3% glowing bright red.

The financial sector was not spared, with the big four banks down between -1.7% and -2.3%. Insurers QBE -1.8%, Suncorp -1.3%, and IAG -1.1% also declined. Suncorp was resilient, considering the disclosure of a prudential breach lodged with APRA last month related to stress-testing requirements.

At the smaller end of town, HUB24 declined -2.1% despite announcing record FUA in the March quarter due to robust flows and market performance. Low cash balances, crimping margins, weighed modestly.

Since breaking out above $33, HUB24 has extended higher to a new record above $42. The downside reversal to $39.80 raises the prospects of a deeper corrective pullback over the coming months. However, the $33 support level should prove formidable. HUB24 has scope for further upside this year and potentially above the record highs with the technical setup continuing to screen bullish.

Meanwhile, payment firm Zip slumped -10.9% despite an initial positive reaction to what looked like a solid 3Q update at the headline level. Digging into the numbers a bit more, a soft transaction volume performance in the Australian business led to some concerns.

In other individual company news/moves, casino operator Star Entertainment was the biggest ASX 200 loser, plunging 14.4% amid ongoing inquiries into the casino operator. Engineering firm Macmahon -4.1% made an all-cash $127 million bid for peer Decmil at a hefty 76% premium, leading to a +64.7% spike for Decmil shares. The deal will expand Macmahon’s (known more for mining services) civil engineering footprint.

Turning to Asia, China’s CSI 300 fell -1.07%, and the Hang Seng fell sharply by -2.12% to the lowest level in five weeks. The primary downtrend for the Hang Seng is providing significant overhead resistance, which might require more time for consolidation ahead of my base case for a coming breakout. Meanwhile, the double bottom at 15000 looks to be conclusive, with an end to the bear market approaching. The forward PE multiple for the HSI has hit rock bottom at 6X.

The weak lead from international markets and risk-averse mood played a key role, but traders also digested a batch of mixed mainland China data. While GDP figures surprised to the upside, other data renewed concerns about a patchy, uneven economic recovery.

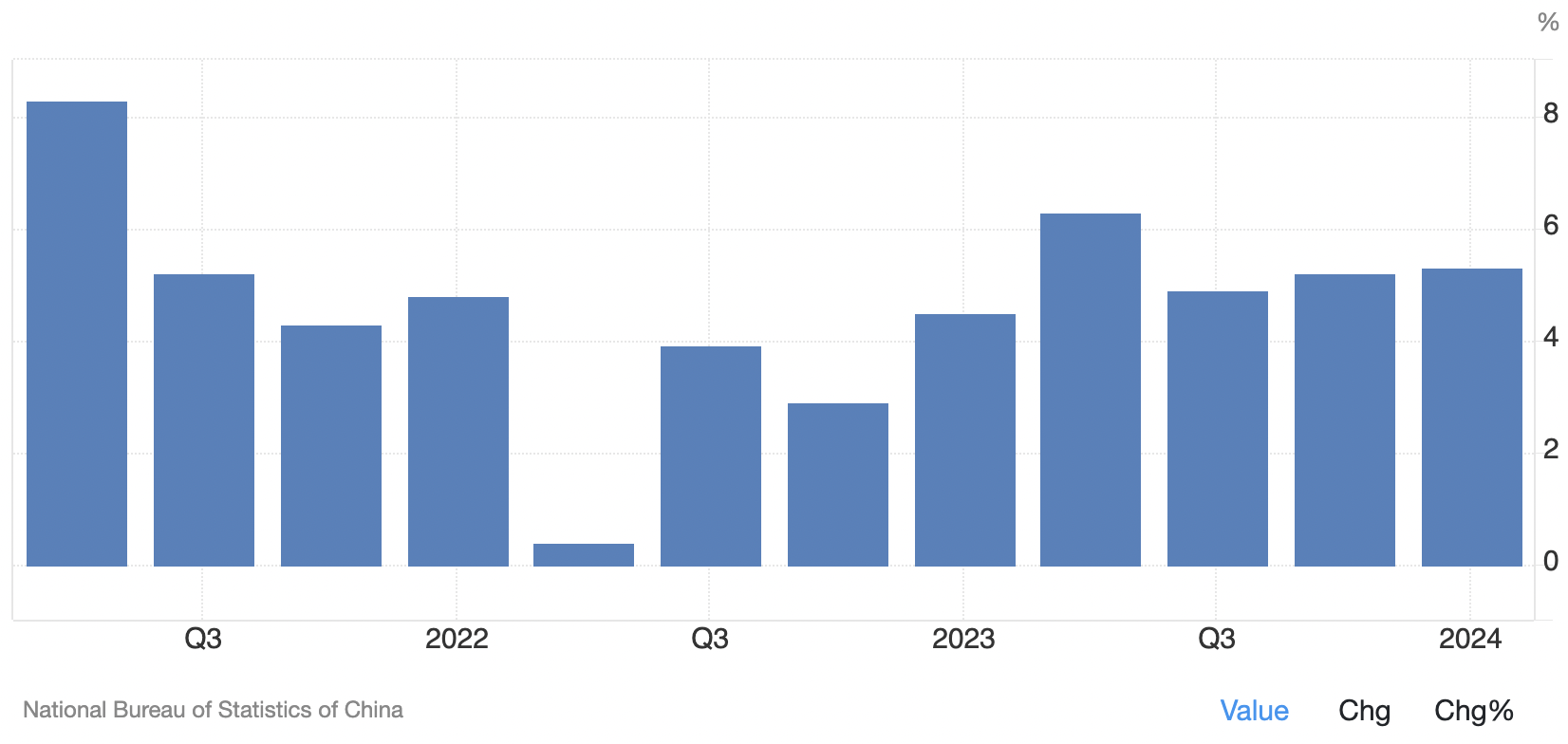

Headlining China’s raft of data on Tuesday was the 5.3% year-on-year GDP growth in 1Q24, accelerating from 5.2% in 4Q23 and topping the anticipated 5% pace. Robust fixed investment helped, and the national statistics agency said the economy is well on track to attain the 5% target for 2024.

China GDP (YoY) – topping expectations

However, the below-expected retail sales and industrial production figures for March removed some gloss. Retail sales growth slowed to 3.1% in March from 5.5% in February, falling short of the expected 4.5% pace. Industrial production cooled sharply to 4.5% from 7% in the prior period and missed the 5.4% consensus. Capacity utilisation was sharply lower across the economy in March. Finally, new home prices dropped 2.2% annually in March, deepening from the 1.4% pace in February and renewing concerns about the embattled property industry. Goldman Sachs suggested that reviving the sector could require an injection of up to US$2.1 trillion, noting that existing rescue efforts have fallen far short.

Losses were broad-based in Hong Kong trading, with only three Hang Seng constituents posting small advances: PetroChina +0.7%, China Overseas Land & Investment +0.2% and China Shenhua Energy +0.2%.

Big tech stocks weighed heavily, with Alibaba -3.3%, JD.com -2%, Meituan -2.9%, Baidu -2.7%, NetEase -2.3%, and Tencent -0.9% falling. The Macau casino operators endured steep losses, including Sands China -6%, Galaxy Entertainment -4.9%, Wynn Macau -3.8%, and MGM China -2.9%. Other consumer stocks slid, including Yum China -2.6%, Li Auto -4.9% and Lenovo -3.9%.

In Japan, the Nikkei -1.94% and Topix -2.04% fell sharply, driven by losses in some heavyweight technology stocks due to rising bond yields. Transportation, Paper & Pulp, Chemical, Petroleum & Plastic, Retailers and Financials also tumbled. Even a weaker yen did little to stem the slide, but there was some dip buying during the afternoon session.

The yen hit new 34-year lows, falling to the mid-154 level against the US dollar. The yield on the 10-year Japanese government bond hit an intraday peak of 0.875%, the highest since last November, before losing some steam to settle at 0.86% by the close of Tokyo trade, little changed from Monday. Financials were broadly lower, led by Nomura -4.5%, SBI Sumishin -4% and Fukuoka Financial -3.8%.

Fujikara -8.4% and Resonac Holdings -7.6%, tech companies which cater heavily to the auto industry, were among the steepest Nikkei fallers, as were retailers J Front Retailing -9.2% and Isetan Mitsukoshi -8.3%. Growth stocks Socionext -6.4% and CyberAgent -6.3% tumbled.

Leading advancers included precision motor maker Nidec +6.9% and medical device firm Olympus +2.4%. Industrial robotics firm Fanuc +2.6%, online fashion platform Zozo +2.9%, Sony +0.6% and video game developer Square Enix +0.8% were among the small group of other advancers. Decliners outnumbered advancers by about 6-to1.

Stocks in London fell on a combination of fears about the possibility of a broader conflict in the Middle East and concerns that a dovish pivot in monetary policy from the Fed and the BOE may not occur as soon as hoped. The FTSE 100 fell -1.82%, while the mid-cap FTSE 250 was down -1.8%.

The big-picture technical outlook for the FTSE100 retains a bullish bias after establishing a lengthy base and consolidation between 2017 and 2024. Since breaking out above historical resistance at 7800, the FTSE has extended into new record territory and has since corrected lower. Support should prove to be deep at and below the 7800. The scope is raised for additional upside over the coming year, and new record highs.

UK data was mixed, as the unemployment rate rose 20bps to 4.2% in the three months to February, above expectations for the figure to be unchanged. On the other hand, wage growth remains elevated, with the average earnings growth rate (excluding bonuses) running at 6.0% in February, just 10bps lower than in January. This prompted fears the BOE may opt to wait longer before trimming interest rates.

Stocks were broadly lower, with just four FTSE 100 constituents posting modest gains: chemical firm Croda International +1.3%, medical device giant Smith & Nephew +0.35%, energy utility Centrica +0.3%, and betting firm Flutter Entertainment +0.1%. These companies operate in defensive industries.

Financial and mining stocks featured heavily in the leading FTSE 100 decliners table, including Standard Chartered -4.5%, Beazley -3.9%, Anglo American -3.4%, Prudential -3.1%, Glencore -3.1%, HSBC -3%, Antofagasta -2.95%, NatWest -2.9%, Rio Tinto -2.9% and Lloyds -2.85%. Antofagasta is a Chilean copper mining giant that is leveraged to the improving outlook for copper prices due to forecasts for demand heavily outweighing supply. This has been reflected in the strong recovery stock price movement over the past six months.

Antofagasta has surged to new record highs above 2300p since breaking through topside resistance this year. Whilst correction risks have risen since the breakout, scope is raised for Antofagasta to extend higher over the coming year in line with rising copper prices. Antofagasta is a top 10 holding in the Global X Copper Miners ETF.

In the FTSE 250, iconic bootmaker Dr Martens plunged -29.4% after another profit warning, with the US market again the problem child. The company warned under a bearish scenario pre-tax profit could fall by two-thirds. Pricing power is soft, and inventory has accumulated. The CEO Kenny Wilson is departing the business.

Defence firm QinetiQ slid 6.7% after announcing that the CFO is leaving the business, effective immediately. A replacement has been named and will join by October.

Packaging giant DS Smith slipped -4% to 393.4p but announced after the close that American firm International Paper will buy the business in a monster £7.8bn all-scrip deal at 415p per share. The offer is far higher than the earlier one from Mondi -1.9%, which valued DS Smith at approximately £6.2 billion.

Elsewhere, Powerhouse Energy rallied +12.5% after announcing that a kiln the business designed has been manufactured by a company in China and is being shipped to the UK. This will speed up feedstock testing.

European stocks fell on Tuesday on general risk aversion and as traders mulled Israel’s potential response to Iran’s missile and drone attack. This more than offset an improvement in economic sentiment highlighted by the ZEW survey, with the headline reading rising 10.4 points to 43.9 in April, the highest level since February 2022 and above market expectations.

Luxury leviathan LVMH -1.6% reported a distinct cooling in sales growth in 1Q, coming in at just 3% on an organic basis as Chinese demand weakened and champagne sales lost fizz. The Wines & Spirits segment endured a 12% slide in sales. The core Fashion & Leather Goods segment posted a modest 2% increase. The star was Selective Retailing as travel continued to recover, with organic sales rising 11%.

Since encountering resistance above 880p LVMH has corrected lower. Further downside extension towards the 760p support level could ensue, which would open a potential buying opportunity. LVMH has remained in a primary uptrend for much of the past ten years.

The major bourses retreated, with the pan-European Stoxx 50 down -1.35%, Germany’s DAX slipping -1.44%, while France’s CAC-40 fell -1.4%. Italy’s FTSE MIB declined -1.65%, and Spain’s IBEX 35 fell -1.5%.

Carpe Diem!

Angus

Disclosure: Fat Prophets and its affiliates, officers, directors, and employees may hold an interest in the securities or other financial products relating to any company or issuer discussed in this report. Fat Prophet’s disclosure of interest related to Investment Recommendations can be provided upon request to members@fatprophets.com.au.